Quick Ratio: Meaning and Formula

Quick Ratio: this article explains the quick ratio in a practical way. Next to what it is (the meaning), this article also highlights the Quick Ratio formula, the interpretation, the main components, benefits of using this ratio an a Quick Ratio example. After reading you will understand the basics of this important financial management tool. Enjoy reading!

What is the Quick Ratio (QR)? The meaning

The quick ratio (also known as the quick assets ratio) is a calculation formula and liquidity indicator that measures to what extent a company can meet its short-term liabilities with liquid assets.

The most important difference with the current ratio is that the quick ratio excludes inventories. The reason for this is the conversion of inventories into cash.

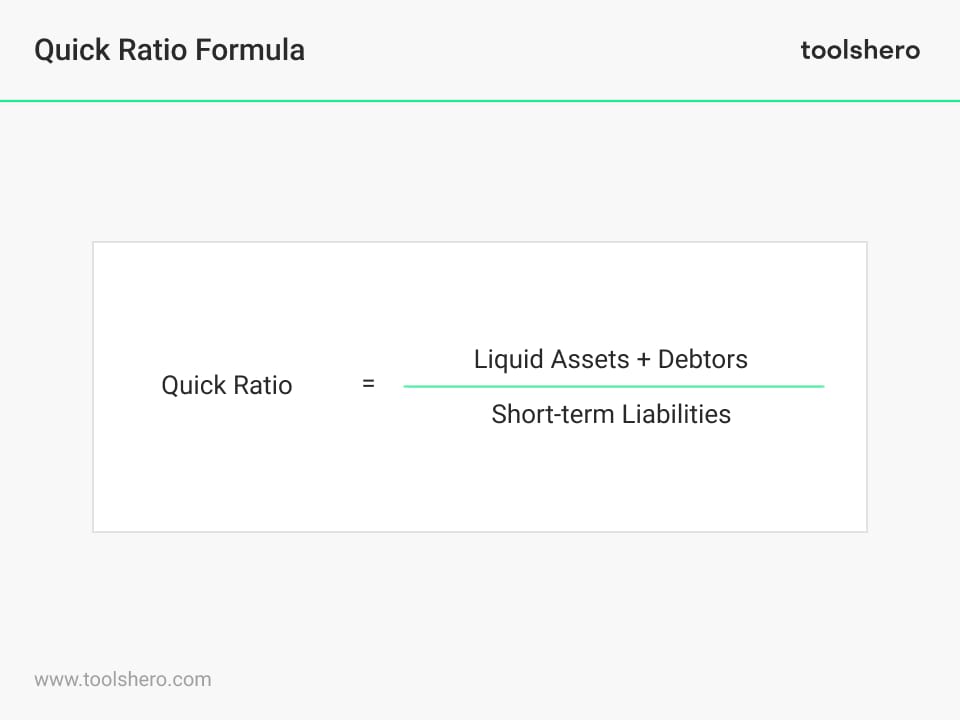

Quick Ratio formula

The formula for the calculation is as follows:

Figure 1 – Quick ratio formula

* = Liquid assets are resources that are readily available such as cash and money in bank accounts. Debtors are the customers who still have to settle their invoices.

** = Short Term Liabilities is the capital that has to be repaid within a short time for example a supplier’s credit, creditors or an overdraft facility.

With the exception of the inventories, this ratio focuses more on the liquid assets of an organization. The basis and use of this ratio is comparable with the current ratio i.e. the ability of an organization to meet their short-term obligations with their short-term assets.

It may be useful to compare the QR with the current ratio. If the current ratio is significantly higher, there is a clear indication the current assets of the organization are dependent on the inventories.

Highlights Quick Ratio

The quick ratio has the following important features:

- Quick ratio says something about an organization’s ability to pay current liabilities without having to sell inventory or require additional financing.

- Quick ratio is generally considered to be more conservative than current ratio, as all current assets serve as backing for current liabilities.

- Quick ratio includes only a company’s most liquid assets, such as cash and marketable securities. These are divided by the total of all current liabilities.

- The higher the ratio, the healthier the company is considered. But a ratio that is too high can also be an indication that the company is not properly able to deploy their liquid assets. The lower the ratio, the more the company struggles to pay debt.

Interpretation of this Ratio

As indicated, a ratio of 1 or higher is considered a normal ratio. This ratio measures the amount in dollars available to pay each dollar in debt. A ratio of 1.05 means that the company has 5 cents more for every euro of debt that it accrues. Investors and analysts see this as a healthy situation.

However, the ratio does not provide a complete picture of a company’s financial health. It is important that other aspects are also examined in order to fully map out the financial health. You can read about that later in the article, under ‘disadvantages and limitations’.

Components of the Quick Ratio

It is clear that only liquid assets are included in this calculation. But what are examples of liquid assets? You can read that below.

1. Cash

Cash money is considered the most liquid of all. That is because this money can be used immediately. For example, it does not have to be sold first. Typically, a company strives to maintain its cash balance at a level equivalent to the monthly income they receive from their financial institutions. This may also include money from abroad.

2. Cash equivalents

For example, an equivalent of cash are certificates of deposit. It is an extension of cash because the account it is held in often includes investments with very low risk and high liquidity. That means it takes very little effort to sell these assets and convert them into cash.

3. Marketable securities

Marketable securities are free from time-related dependencies. This means that these can also be converted into cash very quickly. Still, cost should be taken into account when liquidating them. Early liquidation of interest-bearing assets may result in penalties or discounting of value.

4. Net accounts receivable

Whether debtors are liquid enough to be included under current assets remains a debatable subject and depends, among other things, on the credit conditions that have been provided.

The accounts receivable balance must in any case be reduced by the estimated amount of payments that are considered irrecoverable.

The quick ratio only reflects the money that is immediately available. The calculation should therefore not include elements of receivables that the company does not expect to be able to collect.

Benefits Quick Ratio

This form of liquidity calculation is more conservative than, for example, the current ratio. That is an advantage because it says more about the company’s ability to pay debts in the short term.

The calculation is also simpler and easy to use. The variables are easy to understand and the formula can be used for both a snapshot and a calculation over a longer period of time.

Disadvantages and Limitations

There are also several drawbacks to using the quick ratio formula. This measure does not provide any indication of a company’s future cash flow activities. For example, a company may have a cash flow of 1 million euros today, but if it does not sell anything, it may have difficulty maintaining the cash balance in the future.

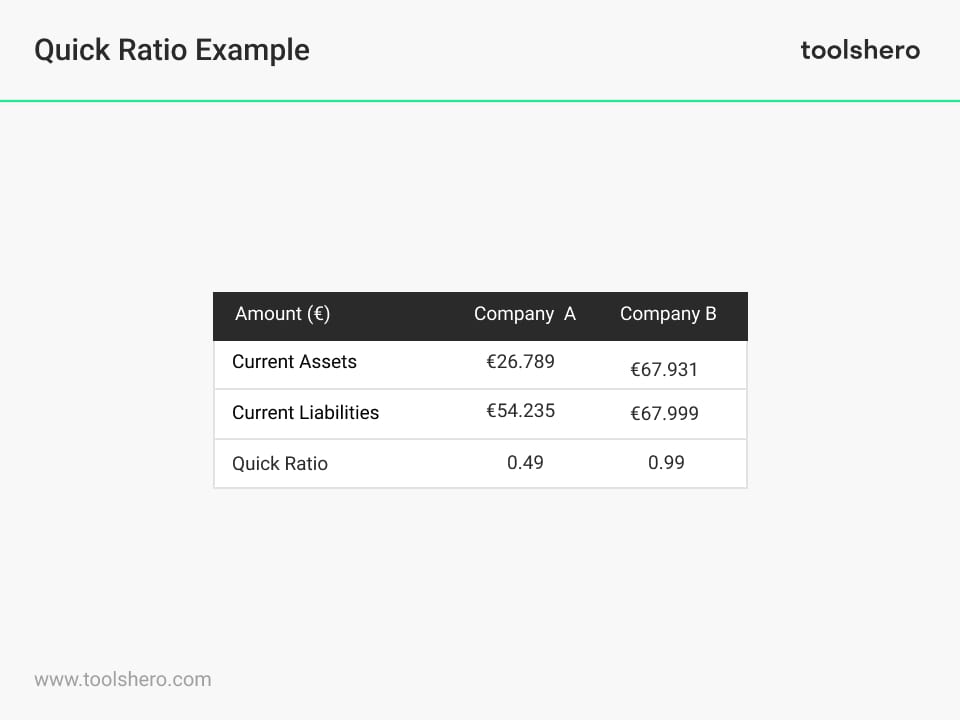

Quick Ratio Example

Consider the example below of the assets and liabilities of Company A and Company B.

Figure 2 – Quick ratio example calculation

Company B appears to be in a good position to pay current liabilities. The assets are greater than the short-term liabilities.

On the other hand, company A is less able to meet obligations. The ratio there is well below 1. This data shows that regardless of current and future earnings, Company B appears to be in better financial health than Company A in terms of its ability to meet debt obligations.

More information

- Berger, A. N., & Udell, G. F. (1995). Relationship lending and lines of credit in small firm finance. Journal of business, 351-381.

- Parrino, R., Kidwell, D. S., & Bates, T. W. (2009). Fundamentals of corporate finance. John Wiley & Sons.

- Ross, S. A., Westerfield, R., & Jordan, B. D. (2008). Fundamentals of corporate finance. McGraw-Hill Education.

How to cite this article:

Van Vliet, V. (2012). Quick Ratio. Retrieved [insert date] from Toolshero: https://www.toolshero.com/financial-management/quick-ratio/

Originally posted on: 05/05/2012 | Last update: 02/01/2024

Add a link to this page on your website:

<a href=”https://www.toolshero.com/financial-management/quick-ratio/”>Toolshero:Quick Ratio</a>