Debt Ratio Analysis

Debt Ratio Analysis: this article provides an explanation of the Debt Analysis. After reading, you’ll have more insight into this financial management tool that indicates which part of a company’s financing consists of debt.

What is a Debt Ratio Analysis?

A Debt Ratio Analysis is defined as an expression of the relationship between a company’s total debt and its assets. It is a measurement for the ability of a company to pay its debts. It indicates what proportion of a company’s financing consists of debts. This makes it a good way to check the company’s long-term solvency. In general a lower ratio is better.

Debt ratio

A debt ratio is a financial ratio that measures the size of a company’s leverage. The debt ratio is defined as the ratio between the total debt and the total assets, expressed as a decimal or a percentage. It can be interpreted as the part of a company’s assets that’s financed with debt.

A ratio greater than 1 shows that a large part of the assets is financed by debts. You could also say that the company has more liabilities than assets. A high ratio also indicates that a company might default on loans if the interest was to go up suddenly. A ratio lower than 1 means that a larger part of a company’s assets is financed by equity.

Analysis

The debt ratio is shown as a decimal because it calculates the total liabilities as a percentage of the total assets. As is the case for many solvency ratios, a lower ratio is better than a higher one.

In most cases, a lower debt quotient means a more stable company with longevity potential because a company with a lower ratio also has less total debt. However, each industry uses its own benchmarks for debts, with 0.5 being an okay ratio.

A debt level of 0.5 is often considered low risk. It means that the company has twice as many assets as liabilities. In other words, the liabilities of this company are only 50 per cent of its total assets. Basically, only the creditors own half the business’s assets, while the company’s shareholders own the rest.

A ratio of 1 means that the total liabilities equal the total assets. In other words, the company would have to sell off all its assets in order to pay its liabilities. This is therefore a highly leveraged company. Once the assets are sold, it won’t be able to operate.

The debt quotient is a fundamental solvency ratio because creditors are always worried about being paid back. When companies borrow more money, their ratio rises. Creditors will no longer want to loan money to them. Businesses with higher debt ratios are better off looking for equity financing in order to grow their activities.

Why schould you use a Debt Ratio Analysis?

The debt ratio is a solvency ratio that measures the total liabilities of a company as a percentage of the total assets. Basically the debt quotient shows a business’s ability to pay its liabilities with its own assets. In other words, it shows how much of its assets the company has to sell to pay all liabilities.

This ratio measures the leverage of a company. Businesses with high levels of liabilities compared to assets are considered to be highly leveraged, meaning they’re a higher risk for investors.

It helps investors and creditors to also analyse the total debt of the company, as well as the ability of the company to pay its debts in future, uncertain economic times.

Getting started with Debt Ratio Analysis

In order to help you do a Debt Analysis yourself, we’ve provided two examples below.

Debt Ratio Analysis Example

Example 1:

A Debt Ratio Analysis with an explanation of how to calculate the debt ratio

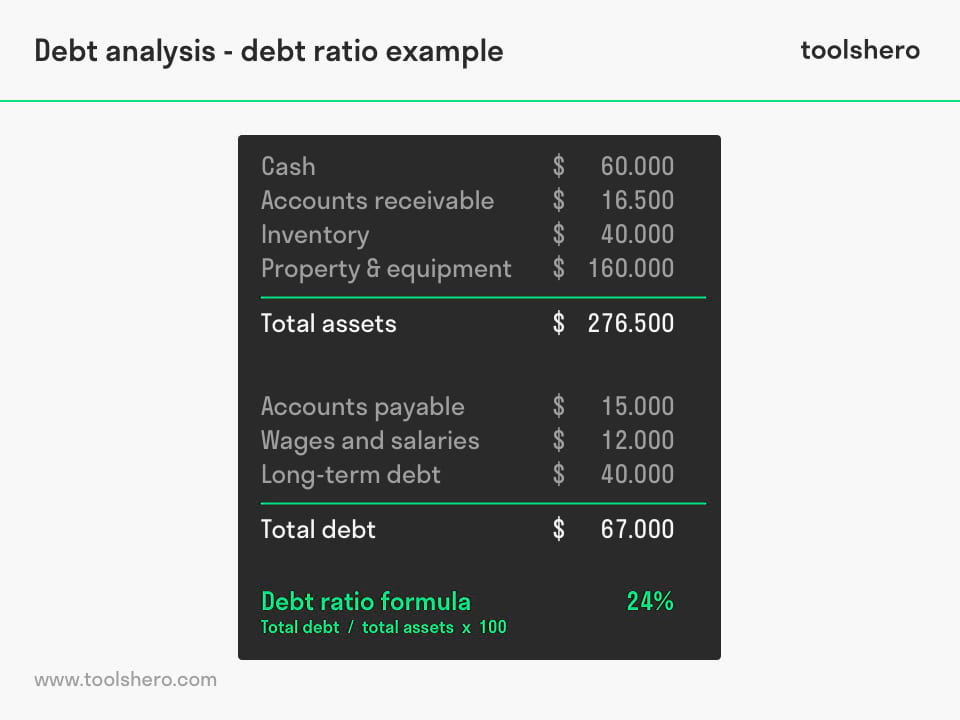

The company BCD was founded a few years ago. At first, the company ran into some difficulty generating sufficient turnover to cover the operational costs. After two years, BCD hit its stride, resulting in considerable sales volumes. As a result, the owners of BCD had to take out a loan to cover the costs of its growth. BCD identified the following figures:

Based on the input described above, BCD has a debt ratio of 24 per cent. A debt ratio of less than 40 per cent is considered healthy, meaning the company is doing well.

A debt quotient of 24 per cent can even be considered a strong financial position. However, you do have to take into account that the total equity of a company is the total amount of a company’s equity. This includes everything of economic value which is expected to generate financial returns in the future. The total debt consists of all liabilities. It therefore includes all short-term and long-term debt. The short-term notes in the above example refer to any liability that has to be paid within a period of twelve months.

Example 2:

A Debt Ratio Analysis with a simple calculation of the debt ratio

Debt ratio formula

Debt ratio = total debt / total assets

Debt ratio calculation: A simple calculation of the debt ratio will put the simplicity of this formula into perspective.

Say a business has $10,000 worth of total assets and $8,000 of total debts. Debt ratio = 8,000 / 10,000 = 0.8

This means that for each dollar worth of assets, the company has $0.8 worth of debt and is financially healthy.

Debt ratio example

Rick is a typical accountant. Every day he works at the office from 9 to 5. Rick makes his money through hours of study, analysis, and dedication. Accounting principles are useful to Rick both in his work life and in his personal life.

Rick is very good at comparing things like debt ratios and mortgages. He is planning to apply his knowledge to his own home financing. The debt ratio analysis he conducts is shown below:

Rick has $10,000 worth of assets and $100,000 of total debt.

Debt ratio = $100,000 / $10,000 = 10

That means Rick has $10 worth of debt for each dollar of assets.

Now it’s your turn

What do you think? Do you recognize the explanation about Debt Ratio Analysis, or do you have anything to add? In which scenarios do you think this analysis would be effective? What do you believe are success factors that contribute to the practical application of this theory?

Share your experience and knowledge in the comments box below.

More information

- Barba, A., & Pivetti, M. (2008). Rising household debt: Its causes and macroeconomic implications—a long-period analysis. Cambridge Journal of Economics, 33(1), 113-137.

- Dornbusch, R. (1993). Stabilization, debt, and reform: policy analysis for developing countries (p. 83). New York: Harvester Wheatsheaf.

- Eaton, J., & Gersovitz, M. (1981). Debt with potential repudiation: Theoretical and empirical analysis. The Review of Economic Studies, 48(2), 289-309.

- Feder, G., & Just, R. E. (1977). A study of debt servicing capacity applying logit analysis. Journal of Development Economics, 4(1), 25-38.

- Hart, O., & Moore, J. (1994). Debt and seniority: An analysis of the role of hard claims in constraining management (No. w4886). National Bureau of Economic Research.

- Johnson, S. A. (1997). An empirical analysis of the determinants of corporate debt ownership structure. Journal of Financial and Quantitative Analysis, 32(1), 47-69.

- Moyer, S. G. (2004). Distressed debt analysis: Strategies for speculative investors. J. Ross Publishing.

- Phillips, G. M. (1995). Increased debt and industry product markets an empirical analysis. Journal of financial Economics, 37(2), 189-238.

- Stulz, R., & Johnson, H. (1985). An analysis of secured debt. Journal of financial Economics, 14(4), 501-521.

How to cite this article:

Sari, J. (2020). Debt Ratio Analysis. Retrieved [insert date] from Toolshero: https://www.toolshero.com/financial-management/debt-ratio-analysis/

Add a link to this page on your website:

<a href=”https://www.toolshero.com/financial-management/debt-ratio-analysis/”>Toolshero: Debt Ratio Analysis</a>