Discounted Dividend Model (DDM)

Dividend Discount Model: This article explains the Dividend Discount Model (DDM) in a practical way. The article starts with a general defintion of the DDM, followed by some general information about why this model is important and why it is used. You will also find practical example calcuations and explanations about the formulae. Enjoy reading!

What is the Discounted Dividend Model (DDM)?

The Discounted Dividend Model (DDM) is a quantitative method for valuing the price of the shares a company has based on the theory that its shares must be worth the sum of all future dividend payments, discounted back to their present value. This means that the stock based model used to value shares based on the net present value of future dividends. It is different from models like the discounted cash flow model, which is used to determine whether an investment is worthwhile based on future cash flows, or models that focus on the expected rate of return for a given investment.

The Dividiend Discount Model assumes that the intrinsic value of a stock showing the value of all future cash flows generated by a security. At the same time, dividends are the positive cash flows generated by the company and distributed to shareholders. This provides an easy way to calculate a fair share price.

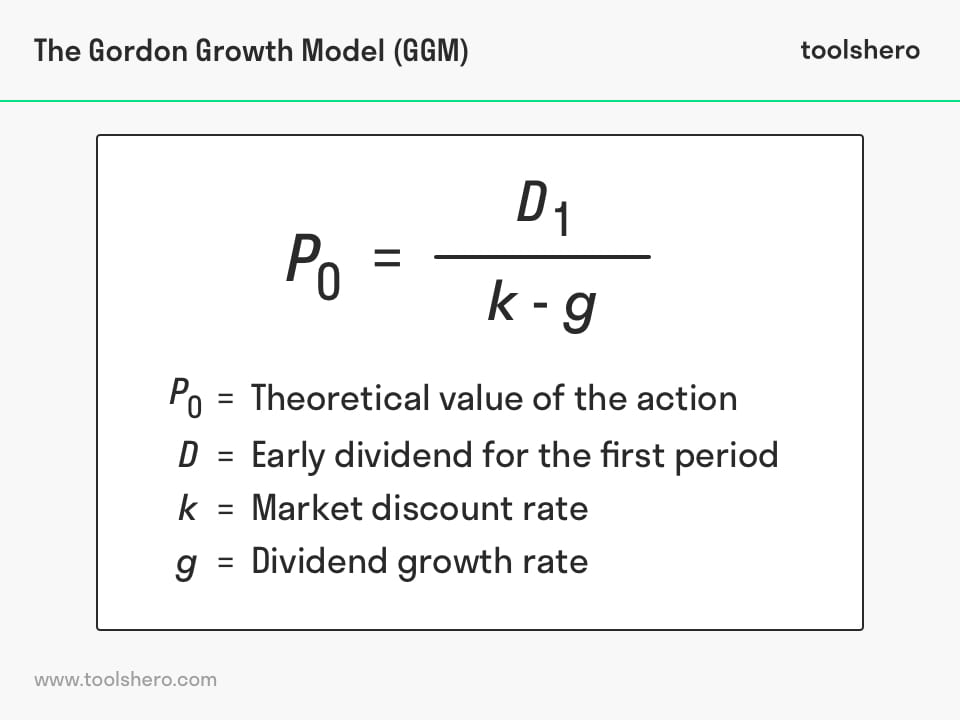

The most widely used equation for this is the Gordon’s Growth Model (GGM), developed by Myron J. Gordon of the University of Toronto who published it together with Eli Shapiro in 1956. His work was based on the theoretical and mathematical ideas found in John Burr Williams’ book “The Theory of Investment Value” in 1983.

What you should know

If the share price in the market is lower than the result obtained by DDM, the share is undervalued, therefore, it is advisable to buy. If, on the other hand, the market price is higher than the model price, it is understood that the share price is very high.

Price = Dividend per share / Discount rate-dividend growth rate

Different variations can be formed depending on the assumptions made. Variations of the dividend model include the following

1. The Gordon Growth Model (GGM)

In this model to determine the value of the share, the present value of the future dividends plus the present value of the future sale value are considered, taking the rate of profit required from shareholders (k) as the discount rate.

Figure 1 – Gordon Growth Model

This model calculates the share price as the current value of a perpetual income with constant growth.

Properties of the Gordon Growth Model

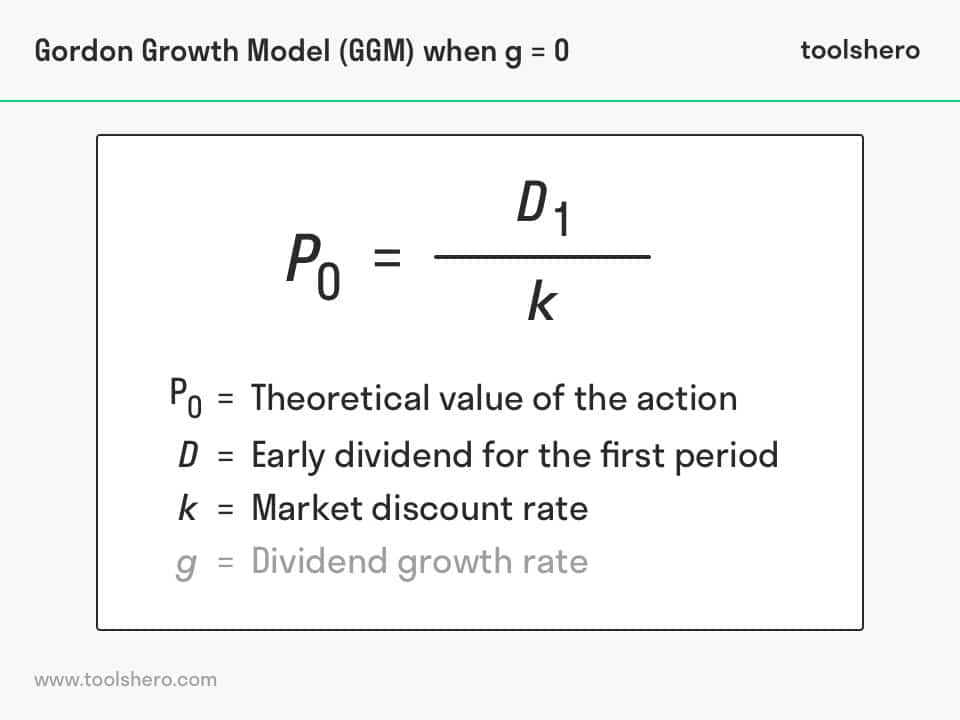

When the dividend growth rate (g) is 0 the model looks like this:

Figure 2 – Gordon Growth Model when g=0

So the market discount rate (k) is cleared, it would be equal to the dividend for the price.

- The company grows at a rate (g) for infinite years

- The company does not go into debt to finance growth

- The growth rate of dividends (g) is always lower than the market discount rate (k)

Disadvantages of the Gordon Growth Model

- The model requires a dividend growth rate (g), and this has to be lower than the market discount rate (k) and higher than (0).

- If the dividend growth rate (g) is very close to the market discount rate (k) the model will be very volatile and the price will be very high.

- Because of its simplicity, this model does not consider important variables that affect the future value of the dividend stream.

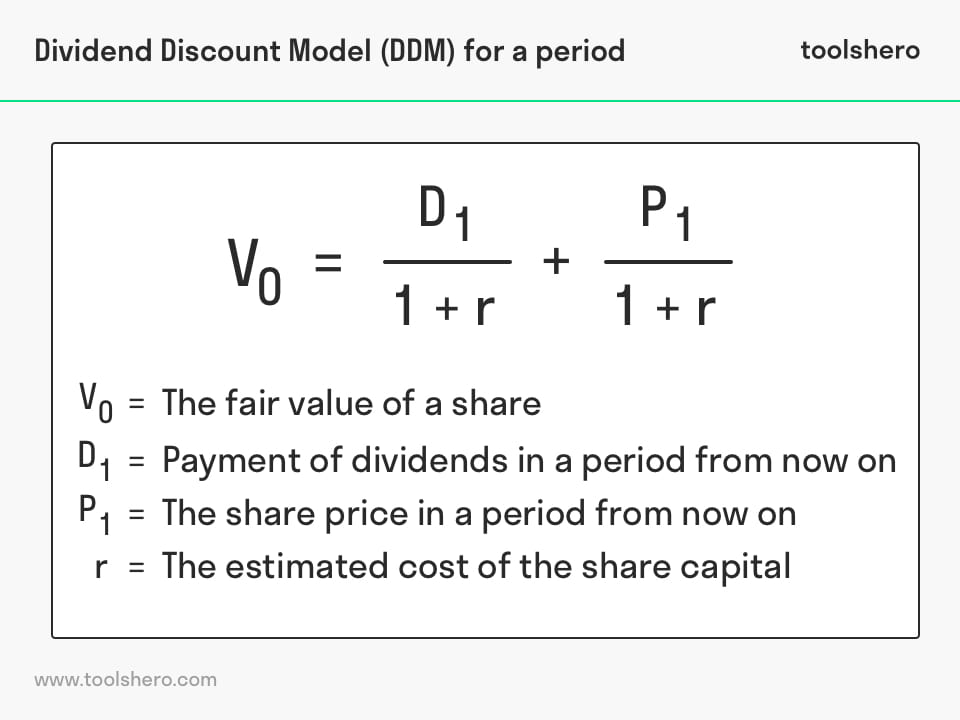

2. Dividend Discount Model (DDM) for a period

This model is applied when an investor wants to determine the intrinsic price of a share he will sell in a period from now on. It uses the following equation:

Figure 3 – Dividend Discount Model for a given period

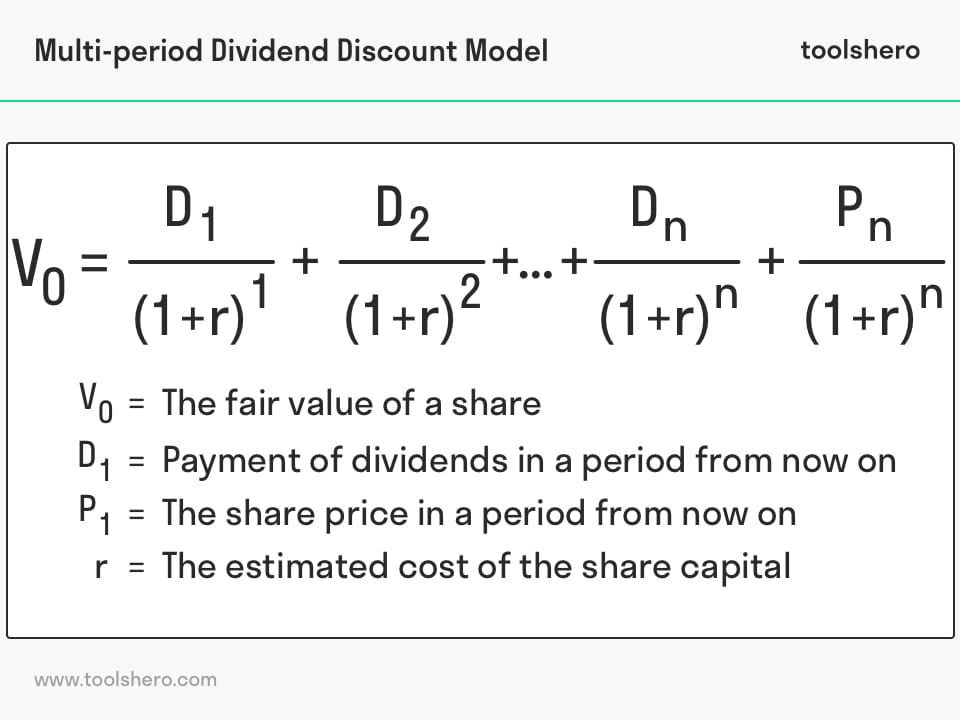

3. Multi-period Dividend Discount Model (stage DDM)

Multi-Period Dividend Discount Models, or Multi-Stage Dividend Discount Models, are an aggregation of the dividend discount model of a period in which an investor expects a share over multiple periods. The main challenge of the multiple period model variation is that it requires forecasting dividend payments for different periods. Note the following formula:

Figure 4 – Dividend Discount Model multi-period

Important elements of the Dividend Discount Model (DDM)

In the formulas above there are some variables for which some explanation is required before it can be applied. The most important parts of the formula are explained below.

Dividend projections

It is often cumbersome to estimate future dividend payments. As mentioned, this includes a lot of speculation and assumptions, or trying to identify trends. Many analysts assume that the company will have a fixed growth rate. This is therefore treated as a perpetual stream. No account is taken of any external factors. The growth rate is calculated based on historical performance data.

Discount rate

The persons owning an organisation, the shareholders, bear the risk of a decline in the value of the shares purchased. In return for that risk, they expect a return on their investment. This is the compensation. The cost of equity of a company is equal to the expected reward that investors demand in return for bearing the risk.

Analysts can estimate the discount factor using the Capital Asset Pricing Model, or the Gordon Growth Model. The return less expected annual growth as the effective discount rate is generally used as the effective discount rate.

Growth rate

The growth rate can be calculated as Return on Equity multiplied by the retention rate. The dividend is paid from the profit the organization has made, and can therefore never be higher than this amount. The return on equity must exceed the expected dividend growth for future cash flows. If this is not the case, it becomes an unsustainable model with negative share prices. However, this is not possible in practice.

Mostly used by shareholders

The most widely used equation is that of Gordon’s Growth Model as it treats dividend growth as if it were constant growth. The payment and distribution of dividends is important because without it the company would not function properly.

All variants of the Dividend Discount Model (DDM) are used to value a share. It also helps in making comparisons between companies, regardless of the sector or industry. This helps investors and shareholders, among other things, to make the right choice for purchasing new shares. Many investors believe in the principle that the present value of a stock reflects the present value of future dividend payments.

They can then use it to identify overbought shares. If the value is calculated higher than the current price of a stock, this indicates a buying opportunity. The stock trades at fair value according to the Dividend Discount Model, the tool that other investors also use.

The DDM is just another tool available for valuing stocks. There are many others, and basing a purchase decision on just one resource probably isn’t wise. The DDM requires many assumptions and predictions, so it is important that these are realistic.

What is the weakness of DDM?

Proponents of this valuation technique are convinced that only future cash dividends are a realistic estimate of a company’s net asset value. Many of the variables needed are based on speculation. Even when the tool is applied to stable and reliable dividend paying companies, there are still many assumptions to be made about the company’s future performance.

Unreliable input = unreliable output

The model is subject to the concept of garbage in, garbage out. This means so much that the model is only as reliable as the assumptions on which it is based. In addition, the input variables are constantly changing and are very prone to errors.

Another shortcoming of the Dividend Discount Model (DDM) is that dividends are referred to as stable indefinitely that grows at a constant rate. In reality, even stable and established companies, it is difficult to predict exactly what the dividend payment will be next year. Let alone say anything concrete about the dividend payment of ten years later.

Not suitable for all businesses

Fast-growing, often new companies, by definition, have a good chance of making a profit in the future. In order to grow, they need more money than is available. Therefore, it is best for such companies to develop more equity or raise debt. For these reasons, they are unable to pay dividends to shareholders.

The DDM can only be applied to mature and stable organizations that have a proven track record of consistently paying dividends. That may not seem like a shortcoming, but it creates a strong interaction. Because investors who only want to invest in stable companies, they run the risk of missing out on the fast-growing companies that don’t yet pay dividends.

Some investors prefer an alternative approach to these types of high-growth companies. They then try to predict the period in which the company will actually evolve from a small company to a mature and stable company. These projections are risky, and more risky the further into the future.

Advantages of the Dividend Discount Model (DDM)

Despite the number of shortcomings of this tool, the very lack of the Dividend Discount Model (DDM) also has some powerful advantages. The method has a strong theoretical background and is a solid mathematical model. The model also eliminates possible subjectivity, only numbers are included in the calculations.

Analysts believe that the DDM is most applicable to companies that do not distribute profits to their shareholders by making assumptions about the dividend these companies could pay.

In Conclusion of the Discounted Dividend Model

Understanding DDM: A company produces goods or offers services for profit. The cash flow from business activities determines its dividends, which are reflected in the company’s stock prices. Organizations also make dividend payments to shareholders, which generally originate from business profits.

The Dividend Discount Model is based on the theory that the value of a company is the present value of the sum of all its future dividend payments. If the company does not pay the dividends, the company would be worthless.

Using DDM to invest allows you to assess current market conditions. This equation allows you to know the value of the stock in its future setting and thus be able to rely on the distribution of those shares at the expected return. This is why Gordon’s model serves to solve the above since it assumes a constant growth rate for dividends.

It’s your turn

What do you think? Do you think the Dividend Discount Model / DDM is a complex tool? Does this tool get used in your working environment? Do you focus on dividends when evaluating investment opportunities? Or Do you focus on the required rate of return? Do you see similarities with other valuation tools? Are you interested in learned more about financial techniques? Do you have questions? Or anything else to add?

Share your experience and knowledge in the comments box below.

More information

- Farrell Jr, J. L. (1985). The dividend discount model: A primer. Financial Analysts Journal, 41(6), 16-25.

- Penman, S. H. (1998). A synthesis of equity valuation techniques and the terminal value calculation for the dividend discount model. Review of accounting studies, 2(4), 303-323.

- Nasseh, A., & Strauss, J. (2004). Stock prices and the dividend discount model: did their relation break down in the 1990s?. The quarterly review of economics and finance, 44(2), 191-207.

How to cite this article:

Ospina Avendano, D. (2020). Discounted Dividend Model (DDM). Retrieved [insert date] from Toolshero: https://www.toolshero.com/financial-management/discounted-dividend-model/

Published on: 03/14/2018 | Last update: 08/15/2023

Add a link to this page on your website:

<a href=”https://www.toolshero.com/financial-management/discounted-dividend-model/”>Toolshero: Discounted Dividend Model (DDM)</a>