VRIO Analysis explained plus example

VRIO Analysis: this article explains the VRIO Analysis in a practical way. Highlighted are: what a VRIO Analysis is, an evaluation of its dimensions and an explanation of how to do this analysis, along with an example. After reading it, you understand the core of this strategy theory. This article also contains a downloadable and editable VRIO Analysis template. Enjoy reading!

What is a VRIO Analysis?

At the start of this century, American management professor Jay B. Barney developed the so-called VRIO Framework, VIRO Framework or VRIO Analysis. The VRIO Analysis is perfectly suited for the evaluation of the use of company resources. Unlike the SWOT-analysis, which is carried for an organization as a whole, the VRIO Analysis evaluates each company asset seperately.

Following this technical analysis, a company will be able to better position itself relative to its competitors. After all, the VIRO Analyis also provides insight into the advantages of an organisation vis-à-vis its competitors. VRIO is an acronym that stands for Value, Rareness, Imitability, and Organisation.

A company’s strategic plan and organisational processes start with the creation of a vision, and is subsequently translated by means of objectives, internal and external analysis, strategical decisions, and implementation.

Thanks to VRIO, a company’s resources and capabilities can be evaluated on a micro level. If a company is aware of all its available resources, as well as the strengths and weaknesses of each option, this will provide sustainable competitive advantages in due time. The opposite is also true: when these factors are not evaluated, this can lead to a competitive disadvantage.

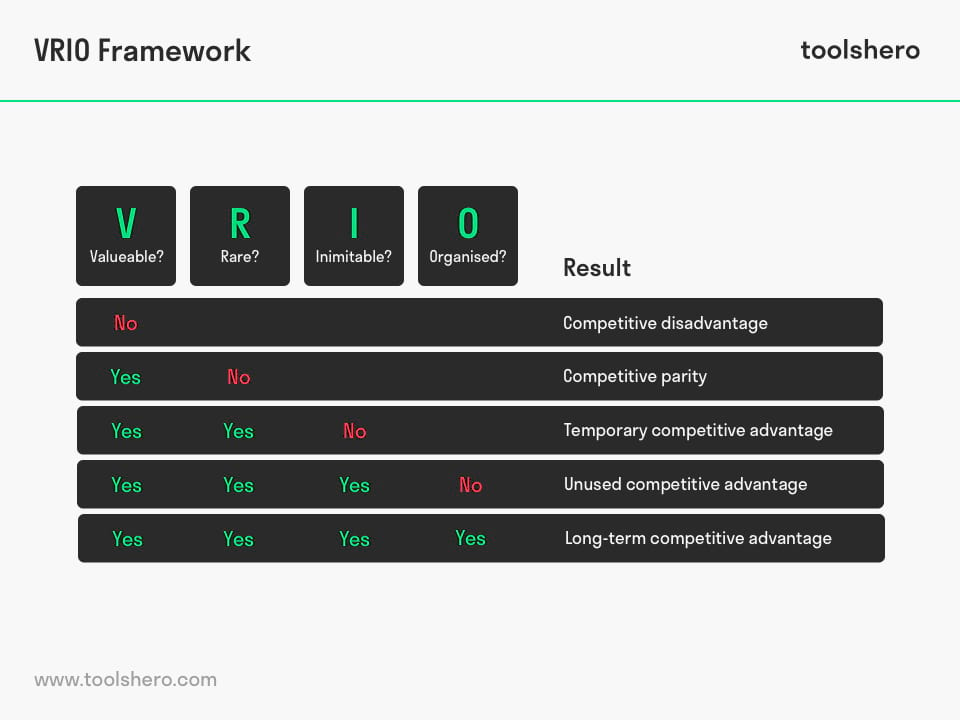

Figure 1 – VRIO Analysis & Framework

Evaluation Dimensions of the VRIO Analysis framework

VRIO is part of an internal analysis, in which both the resources and capacities of a company are scrutinised. The company’s long term competitive advantage is analysed by means of four components. VRIO focuses on company resources, and sets the following evaluation dimensions for four of them:

Value

This refers to the value of the resource used; how expensive is it, is it easily available, should it be purchased, rented, or leased? Should the resource be too expensive, it may be better to outsource it. It is, after all, about utilized opportunities and the value that a resource will ultimately generate for the company.

Take the rental of a large office building, for example. If calculations show the rental fee to be too exorbitant and the purchase of a property would be cheaper in the long run, then it is a good idea to terminate the rental agreement and purchase the property using a loan.

Another good method of identifying potentially valuable resources or capacities is by examining an organisation’s value chain. In case of raw materials, the purchase price must be examined critically.

If a certain component is used over 1,000 times a month, it may be beneficial to make a comparison of different suppliers. For instance, should the component be 5 euros cheaper at another supplier, a significant amount could be saved annually.

Rareness

This element of the VRIO Analysis is concerned with the rarity of the resource or its scarcity when it comes to purchasing. How rare or scarce is the resource? If the resource is valuable, but not scarce, the organisation may compare it to that of competitors.

If it is a very expensive and scarce resource, then the company can use it to distinguish itself from its competitors. The rarer or scarcer a resource, the greater the competitive advantage.

The company will then be able to use an absolutely unique product to keep the competition at bay. Take an exclusive fishing company, for example, which distinguishes itself by being one of the few suppliers of black caviar to high class seafood restaurants.

Imitability

This concerns the degree of imitation when it comes to resources. To what extent is it possible to imitate the product, allowing competitors to produce similar products? When a resource is valuable and scarce and inexpensive to replicate, it will not provide a competitive advantage.

On the other hand, should the resource be difficult to replicate, the competitive advantage will be significant.

For example, where the aforementioned caviar be replaced with pink salmon eggs that are a lot cheaper, it is the taste of the end product that ultimately determines whether this is a good substitute. If restaurants decide against purchasing this alternative for lack of quality, then the competitive advantage is great when it comes to imitability.

If the resource is difficult to imitate, the company must realise that the resource involves considerable costs. Looking for similar products or imitations may be risky, as competitors may do the same.

This will only adversely affect the quality of the end product. Cost of imitation is high to gain competitive advantage because of social complexity, patents, causal ambiguity or unique historical conditions.

In certain cases, the organisation may produce the resource itself and apply for a patent. This assures the organisation that other producers won’t imitate its unique resource. Even if this should happen, it could result in a fine.

Although the use of patents is especially widespread in the pharmaceutical sector, even a company such as Coca-Cola relies on a secret recipe that cannot be imitated by major competitors such as Pepsi Cola.

Organisation

This concerns the arrangement of tasks and the ranking of all actions that are yet to be executed. It goes without saying that the creation of a product requires a lot of resources.

These resources must be ordered, price agreements must be established, comparisons should be made, and assembly must take place. These are merely a few of the actions that require adequate organisation.

The organisation of tasks involves multiple departments on a tactical level. At the same time, operational employees in the workplace must know exactly what is expected of them. Resources must be processed and used as efficiently as possible.

A company should therefore always consider whether its internal administration is in order and whether structural elements are properly adapted to the processing of these particular resources. Is nothing going to waste?

Once a VRIO Analysis has determined the value, scarcity, and imitation level of a product, it is important that all subsequent actions are well organised in order to fully realise the end product or service. The better the internal administration, the greater the competitive advantage. A company’s internal culture is also part of this dimension.

How do employees treat each other? Are they motivated, do they work smoothly and without stagnation? Management teams play an important part in here. Do they stimulate employees by means of bonuses, salary increases, extra holidays, or a nice and pleasant workspace? Without all these elements properly in place, there will be no competitive advantage.

How to do a Vrio Analysis

VRIO is also considered to expand upon the external DESTEP analysis, which involves a more macro level analysis (demographic, economic, social, technological, ecological, and political factors).

VRIO is all about evaluating organisations’ internal situation, analysing resources/ tools in particular and what role they play when it comes to external competition, as well as how the organisation may implement possible improvements across a certain dimension.

After the VRIO Analysis has been implemented, evaluation will follow. This may then be used to make strategic and informed decisions for the future. Precisely because the VRIO analysis is an internal analysis, but at the same time also assesses external competition, it provides companies with a lot of valuable information.

For instance, following this analysis, a company may make adjustments in order to significantly improve its competitive advantage. In some cases it may even result in the outsourcing of certain components, because this will be cheaper in the long run.

At the same time, the VRIO Analysis may also be used in combination with other analysis techniques, including cost/ benefit analyses, quality analyses, and customer satisfaction surveys.

This detailed information provides a wealth of data, which may subsequently result in fundamental changes to business practices. What makes the VRIO analysis particularly effective is the simplicity and clarity of the model.

VRIO Analysis Example

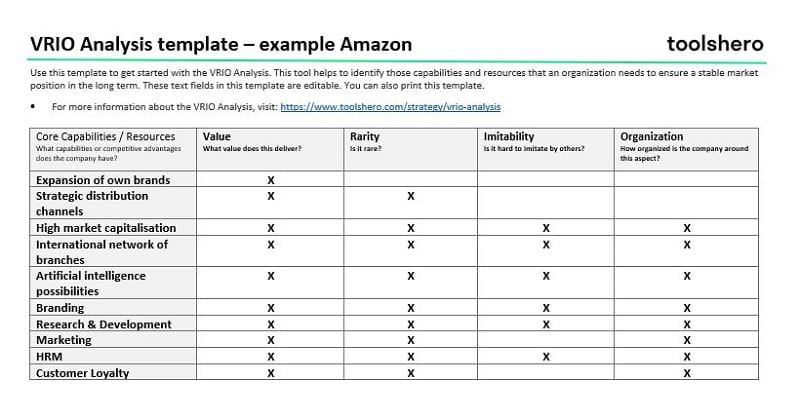

This example examines some of Amazon’s resources and core capabilities. Amazon is a huge e-commerce company, initially specialising in online retail. Later, the company expanded to offer various online and offline services.

VRIO Analysis of Amazon

A VRIO analysis helps to understand how the company manages to grow and strengthen its competitive position. The core competencies and assets that are selected meet all VRIO criteria (value, rarity, inimitability and organisation). Below you can find a selection of company assets and core competencies.

Figure 2 – VRIO Analysis Example

VRIO Analysis template

To get started on performing an analysis yourself right away, you can download a toolshero template below.

The VRIO analysis template can be useful for managers, employees, product developers, project supervisors, team leaders, teachers and students. The text in the template is fully editable and customizable based on the requirements.

Download the VRIO Analysis template

This template is exclusively for our paying Toolshero members. Click here to see if a membership is something for you!Now it’s your turn

Could you use this theory to benefit your business? Do you recognize the practical explanation or do your have any additions? Do you have any tips or tricks that you want to share about using the VRIO Analsyis or an other internal organisation analysis tool?

Share your experience and knowledge in the comments box below.

More information

- Barney, J. B., & Wright, P. M. (1998). On becoming a strategic partner: The role of human resources in gaining competitive advantage. Human Resource Management: Published in Cooperation with the School of Business Administration, The University of Michigan and in alliance with the Society of Human Resources Management, 37(1), 31-46.

- Knott, P. J. (2015). Does VRIO help managers evaluate a firm’s resources?. Management Decision, 53(8), 1806-1822.

- Hesterly, B., & Barney, J. B. (2008). Strategic management and competitive advantage. Prentice Hall.

How to cite this article:

Mulder, P. (2018). VRIO Analysis. Retrieved [insert date] from Toolshero: https://www.toolshero.com/strategy/vrio-analysis/

Original publication date: 01/17/2018 | Last update: 09/07/2023

Add a link to this page on your website:

<a href=”https://www.toolshero.com/strategy/vrio-analysis/”> Toolshero: VRIO Analysis</a>