Financial Forecasting explained

Financial Forecasting: this article provides a practical explanation of Financial Forecasting. It covers a financial forecasting definition, its importance and the different models or types of financial forecasting, along with examples. It furthermore touches on what financial success is, what the basic components of financial forecasting are, what prognoses you can make and if financial forecasting is reliable. Enjoy reading!

What is Financial Forecasting? Definition

Financial Forecasting is the process of estimating or predicting a business’s future financial performance. With a financial prognosis you try to predict how the business will look financially in the future.

A common example of making financial prognoses is the predicting of a company’s revenue. Sales figures ultimately determine where the (commercial) organisation is at. They are therefore important indicators for good decision-making that supports organisational objectives.

Other important aspects of financial forecasting are predicting other revenue, future fixed and variable costs, and capital.

Historical performance data is used to make predictions. These help predict future trends. Companies and entrepreneurs use financial forecasting to determine how to spread their resources, or what the expected expenditures for a certain period will be within their financial planning.

Investors use financial forecasting to determine if certain events will affect a company’s shares. Other analysts use prognoses to extrapolate how trends like the GNP or unemployment will change in the coming year. The further ahead in time, the less accurate the forecast will be.

What makes Financial Forecasting important?

Financial forecasting is a tool for entrepreneurs and CEOs to make better business decisions in a multitude of scenarios. It also helps with:

- Convincing investors to finance a company

- Setting objectives and budgets

When running a company, it’s tempting to only look in the rear mirror by analysing financial data from the past. But the result is that questions like the ones below will remain unanswered:

- How will the future financial situation of my company look?

- How much money can we pay out to shareholders this year?

- How much money can we generate this year to repay debts?

- How long until all debts are repaid looking at the moving averages?

- What will the organisation’s profitability and cash flow look like for the next six to eighteen months?

- How can we achieve our financial objectives form our financial planning?

When financial forecasting is done correctly by a young business owner, the following questions may arise:

- Do I understand the business model well enough to make projections of what is likely to happen in the coming months or years?

- Are there uncertainties (i.e. cost of goods sold) that management will have to address in order to meet financial smart goals?

- Does the organisation have a plan to manage risks that might disrupt growth plans or moving averages?

- How will the organisation use new opportunities in order to grow and increase profitability and cash flow within the financial performance?

Financial Forecasting Models and Methods

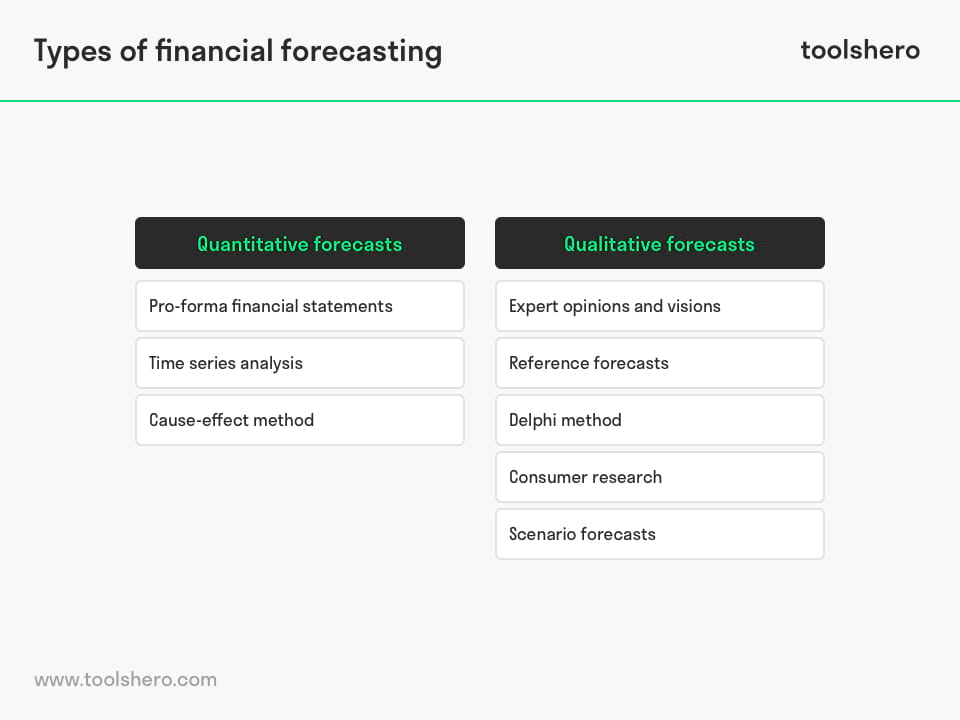

In general, financial forecasts are done in two ways. These are:

Figure 1 – Financial Forecasting Models & Methods

Quantitative forecasts

Quantitative forecasts use analyses of large quantities of historical data to identify trends and patterns. Quantitative forecasts are – generally speaking – less susceptible to skewing than speculative forecasts.

However, if there isn’t much historical data available, the quantitative method becomes less effective. That’s why quantitative and speculative forecasts are often used in tandem.

Examples of quantitative forecasting methods are:

Pro-forma financial statements

Pro-forma financial statements mainly use the sales figures and expected costs of previous years as the basis for making forecasts. More about this later.

Time series analysis

The time series forecast is a popular quantitative forecasting technique that involves collecting data during a certain period in order to identify trends. Time series analyses are one of the simplest ways to use and can be quite accurate, particularly in the short term.

Cause-effect method

In the Cause-effect method, the forecaster looks for cause-effect relationships of variables with other variables like changes in disposable income of consumers, level of consumer confidence, interest rates, unemployment, etc. This method uses time series from the past for many of the relevant variables based on which the forecast is created.

Qualitative forecasts

Speculation is something that’s done based on intuition and experience. The human mind is able to see connections between events and understand the context in ways that computers can’t.

However, people are also prone to having certain biases that make it a challenge to process and analyse large quantities of data. Speculative forecasts are best used in small businesses with little or no historical data available.

Examples of qualitative forecasting methods are:

Expert opinions and visions

For this method, the opinions and key personnel from departments like production, sales, procurement, and operations are gathered to arrive at a forecast.

Reference forecasts

This method is about forecasting the outcomes of planned actions based on similar scenarios from other time periods or places. These forecasts are purely based on human judgement.

Delphi method

For the Delphi method, a series of questionnaires is created and filled out by a group of experts, independently from each other. After the results of the first questionnaire have been collected, a second one is created based on the results of the first.

The second document is again presented to the experts who are then asked to re-evaluate the answers they gave in the first questionnaire. This process will be repeated until the researchers arrive at a shared list of widely held opinions.

Consumer research

Companies often conduct market research among consumers. Data is collected via, for instance, phone calls, interviews, questionnaires, or sample tests. The enormous amount of information that is yielded by this is subjected to analyses in order to generate forecasts.

Scenario forecasts

In this method, the forecaster generates various results based on the outcomes of different scenarios. The management team has final say about which is the most likely outcome of the many scenarios.

What is financial success?

From a financial perspective, commercial organisations face the challenge to perform above average every year when it comes to profitability and cash flow, as well as increasing the value of the company.

The following three aspects define what financial success actually is. If your company considers market research and collects consumer data through the Web, always keep in mind workplace security and protect yourself from data leaks and data breaches. Some organizations don’t give this value.

Profitability

The ultimate test of a business model is whether customers can be attracted and maintained consistently. Having large margins is about selling products or services at a price that offers value to consumers and a healthy gross profit for the organisation. There is also the aspect of managing and controlling costs to have plenty left over on the bottom line.

Cash flow

Profitability also drives the cash flow. The speed with which assets are converted into cash is important. Assets such as inventory and debtors have a substantial impact on the cash flow.

Especially when a business is experiencing strong growth, it’s important to have sufficient liquid assets. Investments that are made by the business are purchases that are made to have sufficient resources to continue to operate in the long term. The liability level and commitments to pay back debts play a significant role in managing and assigning resources on a monthly basis.

Net value

If there is a positive cash flow, the business has to decide what to do with that money. The money can be held onto and reinvested in the company, or it can be used to pay back creditors and shareholders.

Three basic components of Financial Forecasting

Financial forecasting refers to creating certain financial statements. These statements are also called pro-forma statements. Three statements are important when making financial prognoses. These are:

- Income statement

- Cash flow statement

- Pro-forma balance sheet

Some of these statements have to be filled out in the right order. The income statement, or profit-and-loss statement, tells you how much money comes in to the business, and how much goes out. The cash flow statement shows how the money is turned into a profit. The balance sheet helps to predict required payments, assets, and equity.

When these statements are accurate and complete, a business owner can make a financial forecast about how the organisation will look over time.

What financial prognoses should I make?

Using the information from a company’s financial statements, the following prognoses can be made. Depending on the purpose and the use of the prognoses, one of the following forecasts is made.

Sales Prognosis

Sales forecasts are a common form of financial forecasts. Project the company’s sales up to three years in the future based on historical data. Project the company’s sales for the first year, on a monthly basis, or on a quarterly basis.

Cost forecast (budget)

Calculate the fixed and variable costs for the business. Fixed costs are costs like the rent on the building and payroll. Variable costs can be costs such as promotions.

Cash flow statement prognosis

The forecast of the cash flow statement is based on the balance sheet and sales prognoses. This means also using past statements to project the future.

Income statement prognosis

This is a forecast of the business’s profit-and-loss statement. Use the figures from cost forecasts, sales prognoses, and the cash flow statement prognoses.

Assets and liabilities

This covers the assets and liabilities not included in the profit-and-loss statement.

Financial Forecasting: Are forecasts reliable?

When making forecasts, the person doing the forecasting assumes that the future is set. They therefore believe that the future can be predicted. However, nobody would plan for the future if they believed it was certain.

However, most people know it’s impossible to be certain about what will happen. That’s why financial forecasting is a challenging task. Especially if we assume that the future is uncertain.

Extrapolating past trends via Financial Forecasting

Predicting the future is difficult, but predicting the past is very easy. Basically, most forecasts simply extrapolate from past trends. It’s easy to assume that:

- What happened in the past is the most likely outcome for a scenario in the future

- The most likely outcome is the only one that will happen

- Unlikely outcomes are not worth considering

If, in recent years, your organisation has grown by about 5% per year, the assumption for the coming years is that this percentage will be the same, with small variations to account for capacity, optimism, expectations, and other specific factors. But the future rarely imitates the past, especially considering rapidly evolving laws and regulations, geopolitical orders, and economic influences. Predicting the future based on past data is therefore not unlike driving forward while looking in the rear-view mirror.

Striving for precision with Financial Forecasting

Precision is important when it comes to predictions, business plans, and financial models. The thoroughness of carefully examining and modelling each input can determine how accurate the prediction is.

Warren Buffett once said that he preferred being somewhat right over being exactly wrong. Buffett, one of the most famous investors ever, preferred to use paper, pencil, a calculator, and mostly his sharp investor’s instincts for making financial prognoses.

Now it’s your turn

What do you think? Are you familiar with the explanation of financial forecasting? What techniques are used for creating financial prognosis in your professional environment? As an entrepreneur, did you find this article’s information useful? Is the financial future of your organisation on your mind a lot? Do you tend to analyse past results? Do you have any tips or additional comments?

Share your experience and knowledge in the comments box below.

More information

- Abu-Mostafa, Y. S., & Atiya, A. F. (1996). Introduction to financial forecasting. Applied intelligence, 6(3), 205-213.

- Cao, L., & Tay, F. E. (2001). Financial forecasting using support vector machines. Neural Computing & Applications, 10(2), 184-192.

- Kingdon, J. (2012). Intelligent systems and financial forecasting. Springer Science & Business Media.

How to cite this article:

Janse, B. (2020). Financial Forecasting. Retrieved [insert date] from Toolshero: https://www.toolshero.com/financial-management/financial-forecasting/

Original publication date: 06/18/2020 | Last update: 07/31/2023

Add a link to this page on your website:

<a href=”https://www.toolshero.com/financial-management/financial-forecasting/”>Toolshero: Financial Forecasting</a>