RFM Segmentation: basics and an example

RFM Segmentation: this article provides an explanation of RFM Segmentation. After reading, you will gain a better understanding of this marketing tool and how to quickly sort and rank your customers. Enjoy reading!

What is RFM Segmentation?

RFM Segmentation enables marketers to focus on specific clusters of customers with communication that is much more relevant for their specific behaviour, therefore generating much higher response percentages, as well as increased loyalty and customer lifetime value.

It’s an effective way and marketing strategy to identify groups of customers for special treatment.

RFM Segmentation acronym

RFM Segmentation stands for Recency, Frequency, and Monetary Value.

Recency

How much time has passed since the most recent activity or transaction of the customer with the brand? That activity could be a purchase for example, although other variations are sometimes used. Those could be the last visit to a website or use of a mobile app. The point is that the more recent a customer had an interaction or dealt with a brand, the better the odds that they will respond to communication from the brand.

Frequency

How often did a customer have transactions or interactions with the brand during a certain period? It’s obvious that customers with frequent activities are more engaged with and likely more loyal to a brand than customers who only interact with it rarely.

Monetary value

This factor indicates how much a customer has spent on the brand during a certain period. Big spenders should generally be treated differently from customers who don’t spend a lot. The monetary value divided by the frequency shows the average buying behaviour, an important secondary factor to consider when segmenting customers.

Marketers usually have lots of data on their existing customers, including purchase history, browsing history, previous campaign response patterns, and demographics. These can be used to identify specific groups of customers that can be approached with relevant offers.

RFM Segmentation is primarily used for the following three reasons:

- It uses objective, numeric scales that provide a succinct and informative representation of high quality.

- It’s a simple method; marketers can use it effectively without data scientists or advanced software being needed.

- It’s intuitive; the output of this segmentation method is easy to understand and interpret.

Why RFM segmentation?

RFM segmentation is essential because it allows you to quickly categorise and rank customers, plus it’s a very effective way to describe customer behaviour. RFM scores allow you to make lots of useful customer segments. Your top customers have high scores on all three dimensions.

These are customers that score well on recency and monetary value, but lower on frequency because they recently made a purchase. On the other hand there are ‘churn’ customers. These are customers that you’ve basically lost because they haven’t bought anything in a while.

They’ll have high scores when it comes to frequency and monetary value, but low on recency. Finally, there are the low-value customers with low scores on all three dimensions who probably aren’t worth anything. You can save money on marketing by filtering out these users and improving the open-and-click percentages.

The RFM Segmentation analysis answers the following questions:

- Who are my best customers?

- Which customers are about to churn?

- Who have the potential to be converted to more profitable customers?

- Who are lost customers that you shouldn’t put a lot of effort into?

- Which customers should you hang on to?

- Who are your loyal customers?

- Which group of customers is most likely to respond to your current campaign?

Getting started with RFM Segmentation

The RFM Segmentation analysis lets you segment customers based on the frequency and value of purchases and identify customers who spend the most money.

- Recency: how long ago it was that a customer bought something of you.

- Frequency: how often a customer buys from you.

- Monetary value: the total value of the purchases the customer has made.

These statistics let you divide your customers into groups in order to know which customers buy lots of things frequently, which don’t buy much but often, and which ones haven’t bought anything for a while.

Generally speaking, only a small percentage of customers will respond to general offers. RFM segmentation is an excellent segmentation method for predicting customer response, improving interaction, and increasing profit. RFM Segmentation uses customer behaviour data to determine how you should approach each customer group.

Using RFM segmentation and RFM analysis step by step

Here follows a step-by-step approach to RFM segmentation.

RFM Segmentation Example

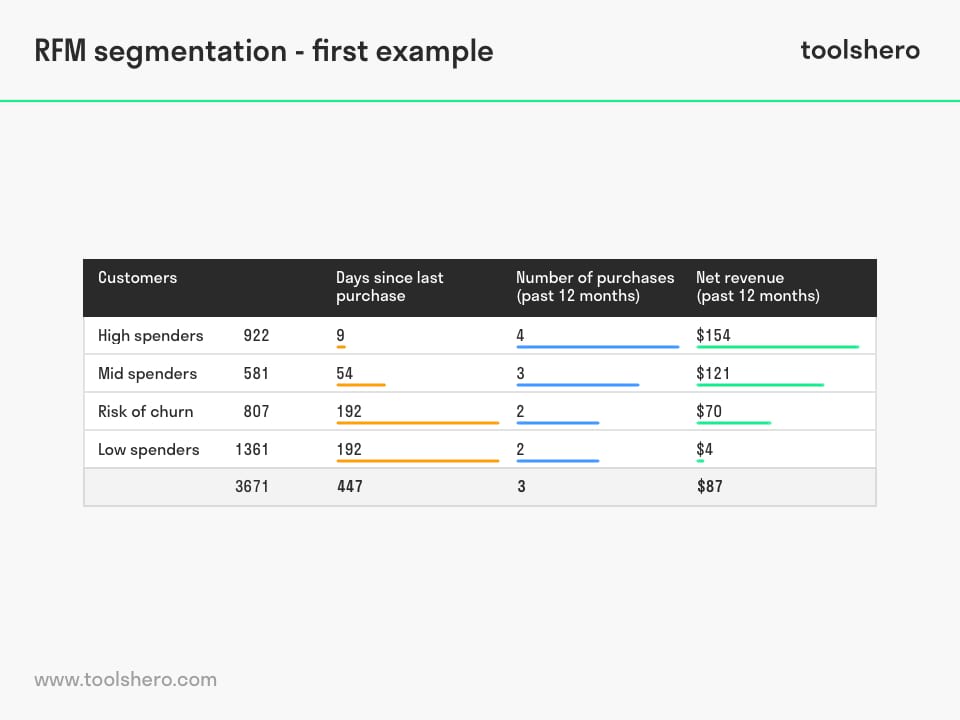

Example customer cluster analysis result

The following graph shows the result of a three-dimensional cluster analysis that was conducted for the customers of an e-commerce website. This analysis resulted in the discovery of four customer persona.

The separate customer persona that were discovered through cluster analysis enable marketers to model their customers and personalise marketing efforts for much better effectiveness.

Figure 1 – example of a RFM Segmentation

Second RFM Segmentation Example

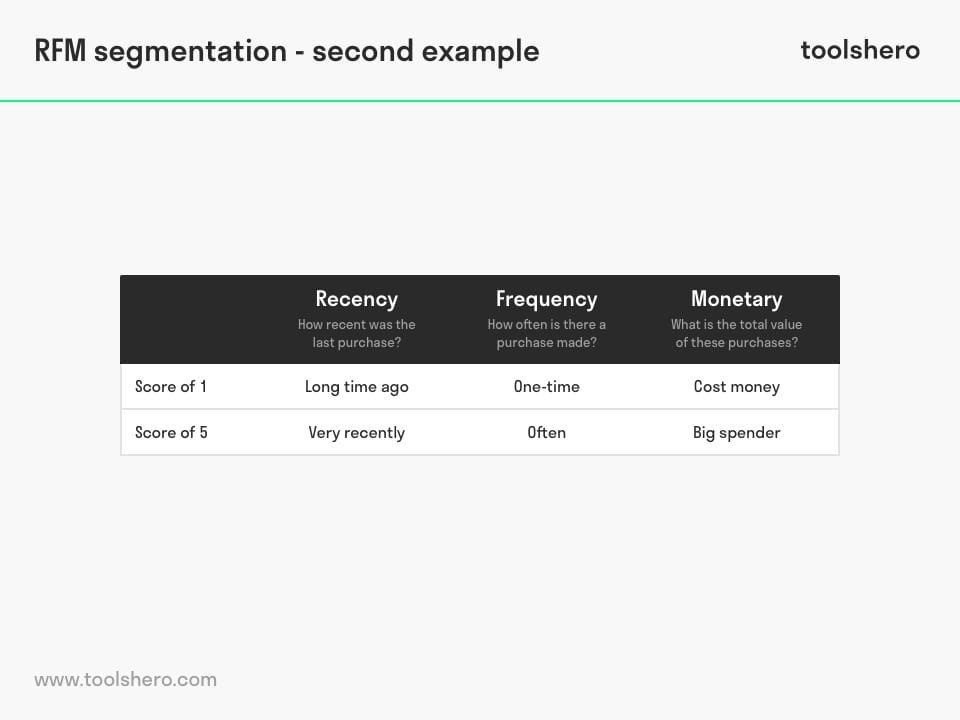

The RFM Segmentation model is a tool to determine when a customer last came to you to buy something (recency), how often they bought something (frequency), and what the value of those purchases was (monetary value). All three factors can be scored, for instance using a scale of 1 to 5.

A 1 is a low score, a 5 is a high score. Basically, it doesn’t matter whether you use a scale from 1 to 5 or 1 to 100; as long as you can differentiate customers and customer groups.

Figure 2 – second example of RFM Segmentation

Step 1

The first step when creating a RFM Segmentation model is assigning recency, frequency, and monetary values to each customer. The unprocessed data, which should be instantly available in the company’s CRM or transaction databases, can be gathered in an Excel spreadsheet or database:

- Recency will be the time that has passed since the customer’s last transaction (you can use days, but also months, weeks, or hours.)

- Frequency is the total number of transactions that the customer performed (during a defined period).

- Monetary value is the total amount that the client has spent on all transactions (during defined period).

Step 2

The second step is dividing the customer list into groups for each of the three dimensions (R, F, and M), for instance using an excel sheet or other instrument. It’s recommended to divide the customers in four layers for each dimension, so that each customer in each dimension is assigned to one layer:

- Recency Frequency Monetary

- R tier-1 (most recent) F tier-1 (most frequent) M tier-1 (highest spending)

- R tier-2F-diagram-2 M-diagram-2

- R-diagram-3 F-diagram-3 M-diagram-3

- R tier-4 (least recent) F tier-4 (only one transaction) M tier-4 (lowest spending)

This results in 64 different customer segments (4x4x4). It’s also possible to use three layers (resulting in 27 segments). The use of more than four is not recommended, as the increased usage difficulty isn’t worth the higher detail.

More advanced and less manual approaches – such as K averages cluster analysis – can be performed using software, resulting in groups of customers with more homogeneous characteristics.

Step 3

The third step is electing groups of customers to whom specific types of communication will be sent based on the RFM segments in which they are represented.

It’s a good idea to assign names to interesting segments. Examples include:

- Best customers – this group consists of customers that can be found in R tier 1, F tier 1, and M tier 1, which means that they had recent transactions, have frequent transactions, and spend more than other customers. A shorter way to define this segment is 1-1-1; we’ll be using that from now on.

- New customers who spend a lot – this groups consist of 1-4-1 and 1-4-2 customers. These are customers who only had one transaction, but it was recent and they spent a lot.

- Lowest loyalty active loyal customers – this group consists of the customers in segments 1-1-3 and 1-1-5 (they had recent transactions and have them frequently, but spend the least).

- Best loyal old customers – this segment consists of the customers in groups 4-1-1, 4-1-2, 4-2-1, and 4-2-2 (they had frequent transactions, but it’s been a while since the last one).

For marketers, it’s very important that they create groups that are the most relevant for their specific business objectives and retention targets. This is also called SMART marketing.

Step 4

The fourth step actually goes beyond the RFM segmentation itself: creating personal message that are tailored to each customer group. By focusing on the patterns of behaviour of certain groups, RFM marketing enables marketers to communicate with customers much more effectively.

Now it’s your turn

What do you think? Do you recognise the explanation of RFM segmentation, or do you have anything to add? In which scenarios do you think this method will be effective?

What do you believe are success factors that contribute to the practical application of this theory?

Share your experience and knowledge in the comments box below.

More information

- Kohavi, R., & Parekh, R. (2004, April). Visualizing RFM segmentation. In Proceedings of the 2004 SIAM international conference on data mining (pp. 391-399).

Journal of business research, 60(6), 656-662. - Miglautsch, J. R. (2000). Thoughts on RFM scoring. Journal of Database Marketing & Customer Strategy Management, 8(1), 67-72.

- Yang, A. X. (2004). How to develop new approaches to RFM segmentation. Journal of Targeting, Measurement and Analysis for Marketing, 13(1), 50-60.

How to cite this article:

Sari, J. (2020). RFM Segmentation. Retrieved [insert date] from Toolshero: https://www.toolshero.com/marketing/rfm-segmentation/

Original publication date: 06/29/2020 | Last update: 09/19/2023

Add a link to this page on your website:

<a href=”https://www.toolshero.com/marketing/rfm-segmentation/”>Toolshero: RFM Segmentation</a>