Activity Based Costing (ABC)

Activity Based Costing (ABC): this article explains Activity Based Costing (ABC) by Robert Kaplan in a practical way. Highlights include: what Activity Based Costing is, what its benefits and drawbacks are and what it looks like in a model versus traditional costing. After reading you will understand the basics of this financial management tool. Enjoy reading!

What is Activity Based Costing (ABC)?

Activity Based Costing (ABC) is a costing system that goes beyond traditional cost price models with respect to indirect cost calculation models, like Absorption Costing and Direct Costing.

This method was developed in the United States. Robert Kaplan is regarded as the founder of the theoretical principles of activity based costing within the cost management knowledge area.

In the 1970s the ABC method was introduced in the manufacturing industry to solve the problems of traditional cost price calculation. In the 1980s, the authors Robin Cooper and Robert Kaplan wrote numerous articles about this.

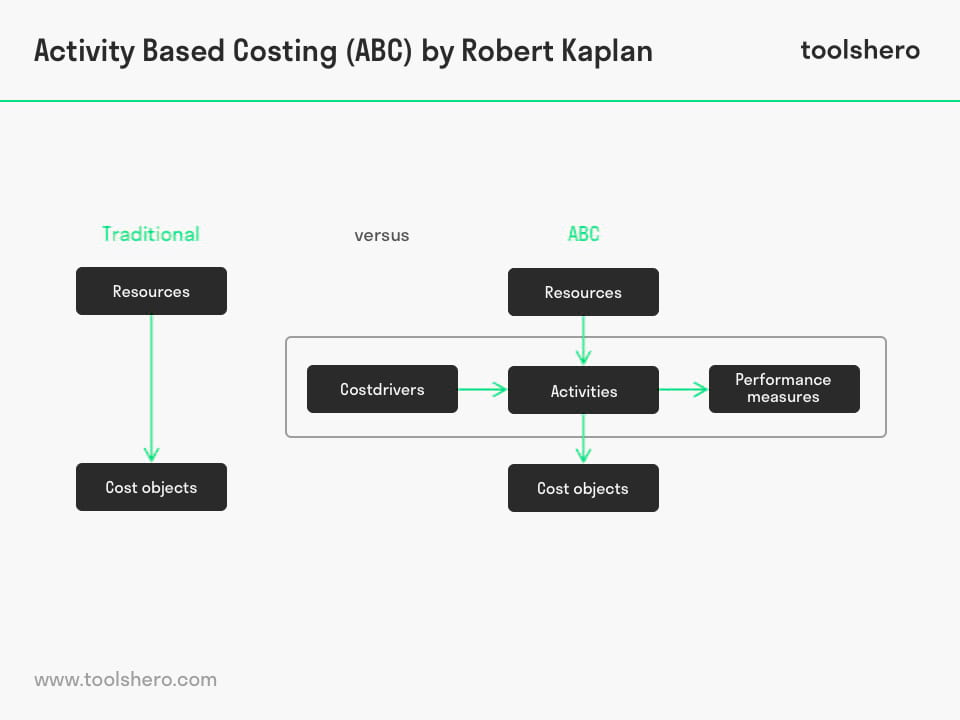

In traditional cost price systems such as the cost centre and surcharge methods, indirect costs are allocated based on volumes of products, for instance hours of labour and machine hours. The costs are not allocated to the cost drivers and there is no causal relationship.

This makes it hard to determine the costs of the production factors and manufacturing overhead costs as a result of which a distorted picture may be presented in terms of costs. It is also nearly impossible to accurately determine factors like cost per unit, which are important measures.

Unlike traditional cost price systems, activity based costing does establish a causal link between the cost drivers and indirect costs. By passing on this insight to the responsible cost drivers, a transparent and cost-conscious conduct is stimulated.

The implementation of Activity Based Costing can help employees to understand the different cost categories and to analyse activities that add value. This is also a way to find out what activities do not add value and should therefore be eliminated.

In this manner improvements can be realized that can lead to higher performance results. It also contributes to strategic developments within cost price calculations. More accurate cost information can help an organization respond to competitive advantage and certain decisions in the Ansoff Matrix (PMM).

ABC identifies cost groups of activity centres in organizations and allocates costs to products and services based on a number of events or transactions that are absolutely necessary in a process to deliver the product or service.

Figure 1 – Activity Based Costing (ABC) versus traditional costing

Benefits and drawbacks of activity based costing

- With the introduction of ABC the integral cost price of products can be calculated more accurately.

- Through simulation it is easier to calculate the effect of for instance changes in set-up times, fewer defective products, etc.

- By making the cost drivers clear, the departments accountable are stimulated to search for improvements of the production process to make them act more cost-conscious.

- ABC provides a clear picture of the behaviour and structure of the indirect costs. This is how for instance overheads can be managed much better.

- ABC can contribute to better cost price calculations for the benefit of the corporate strategy on the market.

- ABC is a fairly complex system and this is also the biggest drawback of the system.

- When implementing ABC, a lot of time needs to be spent on defining the activities, the calculation of the cost price and the finding of cost drivers. This requires a company to provide detailed cost information which in turn leads to a complicated process.

- ABC systems are expensive and they are complicated to maintain and adjust.

ABC is cost price calculation, in which the cost drivers are allocated to the costs incurred.

In this system it is assumed that there is a causal link between the products and the accompanying costs. Activity Based Costing is especially interesting for companies that, in the light of bad corporate results or strategic considerations (cost leadership), need to achieve an important cost reduction.

Cost reduction may in this respect also be translated into a better operational efficiency. Activity Based Costing is also often used as the basis for the use of a Balanced Scorecard (BSC) within an organization.

Introducing activity based costing is not a simple task: it is a long and rigorous process and it is certainly not “as easy as A, B, C”.

Now It’s Your Turn

What do you think? Is Activity Based Costing applicable in today’s modern economy and organizations? Do you recognize the practical explanation or do you have more suggestions? What are your success factors for using a certain costing method? Do you find it difficult to do cost accounting, product costing or to assign costs objects in general?

Share your experience and knowledge in the comments box below.

More information

- Garrison, R., Noreen, E. and Brewer. P. (2012). Managerial Accounting. McGraw-Hill.

- Kaplan, R. & Anderson, S. R. (2007). Time-Driven Activity-Based Costing: A Simpler and More Powerful Path to Higher Profits. Harvard Business School Press.

- Shaban, A. (2009), Activity Based Costing ABC Adoption & Succes factoren [Activity Based Costing ABC Adoption & Succes factors], paper Faculty of Economics and Business Administration, Vrije Universiteit Amsterdam.

How to cite this article:

Van Vliet, V. (2009). Activity Based Costing (ABC). Retrieved [insert date] from Toolshero: https://www.toolshero.com/financial-management/activity-based-costing-abc/

Original publication date: 03/14/2009 | Last update: 10/23/2023

Add a link to this page on your website:

<a href=”https://www.toolshero.com/financial-management/activity-based-costing-abc/”>Toolshero: Activity Based Costing (ABC)</a>