Acquisition Integration Approach Model

Acquisition Integration Approach Model: this article explains the Acquisition Integration Approach Model, developed by Philippe Haspeslagh and David Jemison, in a practical way. After reading you will understand the basics of this powerful strategy tool.

The acquisition integration approach model

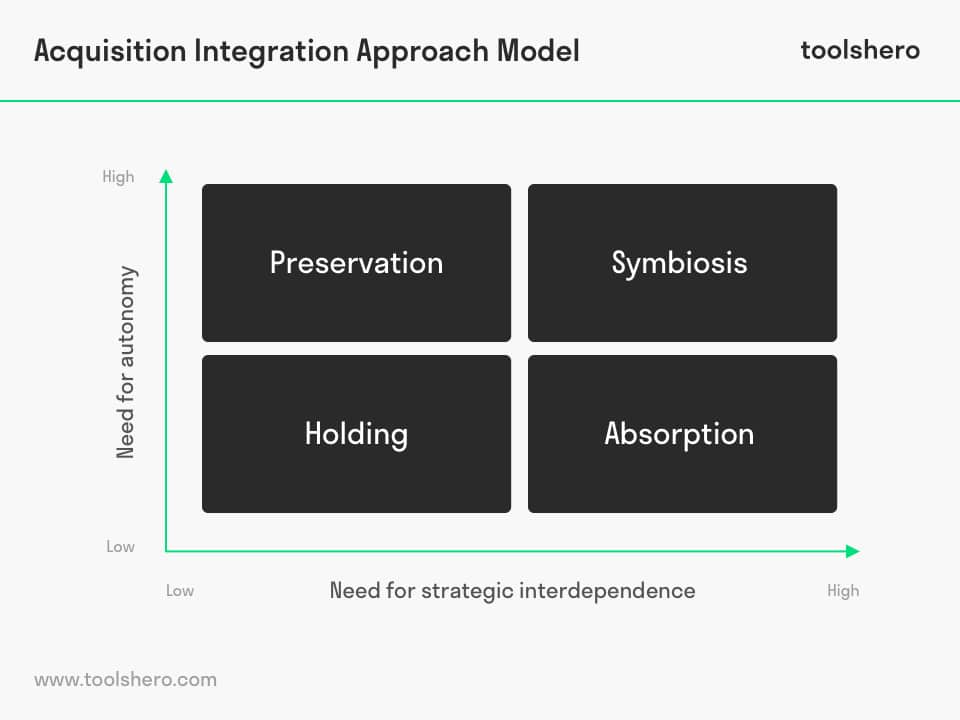

This acquisition strategy model was developed by Philippe Haspeslagh and David Jemison and they indicated that integration should meet two important criteria, namely:

- Need for strategic interdependence

- Need for organizational autonomy

The acquisition integration approach model or AIA model provides insight and guidance in mergers and acquisitions on choosing the best integration approach.

Need for strategic interdependence

The most important goal or task in an acquisition is the creation of value. This value is enabled when two companies or organizations are combined.

There are four types of value creation:

Resource Sharing

Value is created by combining companies at operational level.

Combination benefits

Value is created by borrowing capacity, a greater market power, by leverage cash resources or shared purchasing power (shared services).

General Management Skill Transfer

Value is created by improved insight, coordination and control by the management).

Functional Skill Transfer

Value is created by sharing information, knowledge or by moving people to various positions in a merged organization.

Need for organizational autonomy

The need and necessity for organizational autonomy can be answered using three basic questions:

- How much autonomy should be allowed in the required situation?

- Where or in which areas should this autonomy be allowed?

- Is autonomy essential to preserve the strategic capabilities?

The preferential acquisition approaches are:

- Preservation: management needs to focus on keeping the source of the acquired benefits intact.

- Absorption: management needs to ensure that its vision for the acquisition is carried out well.

- Holding: creation of basic values by risk-sharing, general management capability or financial transfers. There is no intention of integration.

- Symbiosis: the joint forces but also boundary preservation and boundary creation.

Companies that are seriously considering a large scale acquisition process within a year, can start by setting up a preparatory phase in which a group of people can make the necessary preparations for this acquisition.

It’s Your Turn

What do you think? Is the Acquisition Integration Approach Model applicable in today’s modern economy? Do you recognize the practical explanation or do you have more suggestions? What are your success factors for a good acquisition strategy?

Share your experience and knowledge in the comments box below.

More information

- Blumenthal, B., & Haspeslagh, P. C. (1994). Toward a definition of corporate transformation. Sloan Management Review, 35(3), 101-106.

- Haspeslagh, P. C. & Jemison, D. B. (1986). Acquisitions: Myths and reality. Insead.

- Haspeslagh, P. C. & Jemison, D. B. (1991). Managing acquisitions: Creating value through corporate renewal. Free Press.

How to cite this article:

Van Vliet, V. (2011). Acquisition Integration Approach model. Retrieved [insert date] from Toolshero: https://www.toolshero.com/strategy/acquisition-integration-approach-model/

Published on: 02/02/2011 | Last update: 05/12/2022

Add a link to this page on your website:

<a href=”https://www.toolshero.com/strategy/acquisition-integration-approach-model/”>Toolshero: Acquisition Integration Approach model</a>