Net Present Value: formula and example

Net Present Value: this article explains the concept of a Net Present Value or NPV. It describes what NPV is, how it can be calculated using the NPV formula and what it looks like in an example. After reading you will understand the basics of this financial indicator. Enjoy reading!

What is the Net Present Value?

The Net Present Value (NPV) represents the Net Constant Value, with which the profitability of an organisation can be easily calculated.

It is a useful tool for the budgeting of the working capital in order to determine whether a project or investment will be profitable or will result in a loss.

Net Present Value is the sum of all discounted future cash flows.

Within a certain period, the difference between the present value of the outgoing cash flows and the present values of the influx of all cash resources is examined. Usually it concerns a period of one year, a half year, or a quarter.

The outcome forms the basis for the Net Present Value Rule; this prescribes that investments should preferably be made when the NPV values are positive.

With a positive Net Present Value, the expected income will be higher than the expected costs.

Difference amount

Net Present Value can also be described as the ‘difference amount‘ between the cash inflow and the outflow of money. A comparison is made with the current value of the investment and the future value that it will generate.

Additionally, inflation and the return on investment are taken into account. NPV is then determined by calculating both the costs and the advantages for each period of an investment.

Theoretically it would be nice, when organisations do investments and strive for a positive NPV. In practice however, it often happens that only those investments or projects that have been calculated to have a high NPV, get the right of way.

Regardless, NPV is used as a part of DCF-analysis (Discount Cash Flow), to determine the investment of a long term project, for example with a takeover or fusion.

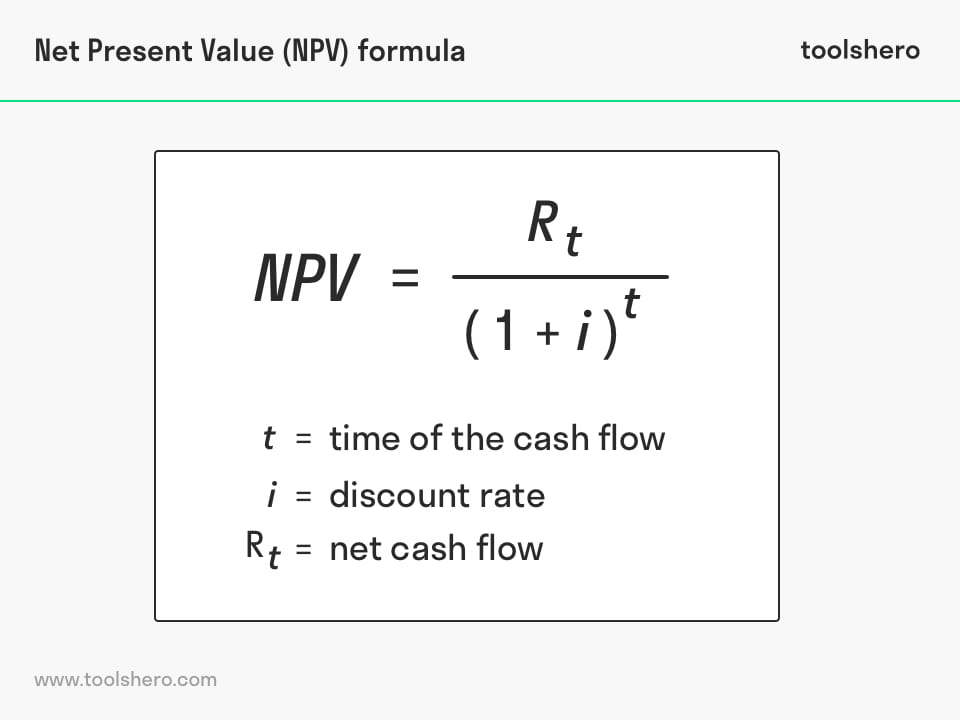

Figure 1 – Net Present Value formula

Net Present Value: time value

Determining the future value of a project demands skill and knowledge. There are different ways to calculate and measure this value.

Additionally, money has a certain time value that plays a part in the calculation of the Net Present Value; often this monetary value is higher in the present compared to the value of the same amount in the future. This has to do, among other things, with inflation.

Where 20 years ago a monthly salary was 2,500 guilders, this monthly payment is now made in euro’s, whilst the euro had more than twice the value of guilders back then.

This difference can be made transparant by, for example, comparing the expected return on other investment choices with that of the intended investment.

Practical example of the Net Present Value

Let’s say that a large well-known coffeehouse chain wants to take over an already existing lunchroom located in a busy street in a random city. This has different advantages for the coffeehouse chain. They can establish themselves on a popular location and secondly it offers the opportunity to tap into a new branch with a different product range.

For the coffeehouse chain, it’s important to first gain sight into the possible future cash flows of this lunchroom. If the financial future doesn’t look positive, the chances are small the acquisition will lead to a success. Next, the investment made by the coffeehouse chain, let’s say 500k euro’s, must be deducted from the cash flow income.

If the current owner of the lunchroom wants to sell his business for more than 500k euro’s the large chain will probably accept this if it will deliver a positive NPV.

It may also be the case that the lunchroom owner agrees to sell his business for 400k euro’s. In that case the investment will represents a profit of 100k euro’s (500k-400k) for the coffeehouse chain during the calculated investment period.

It is also possible that the owner doesn’t want to sell his business for less than half a million euro’s.

The coffeehouse chain can then decide to abandon the purchase because the acquisition will result in a negative Net Present Value, which will ultimately lower the total value of the coffeehouse chain.

Estimations

Assessing the profitability of an investment is not entirely reliable and is not always based on facts. NPV is strongly dependent on multiple assumptions and estimations, which can result in mistakes. This plays a part in, among other things, the estimation of investment costs, the discount foot, and the return on interest.

Additionally, unforeseen expenses can come up during a project, resulting in more money flowing out.

It’s Your Turn

What do you think? How do you apply the Net Present Value in your business life? Do you recognize the practical explanation or do you have more additions? What are your success factors for conducting financial calculations such as the Net Present Value?

Share your experience and knowledge in the comments box below.

More information

- Beaves, R. G. (1988). Net present value and rate of return: implicit and explicit reinvestment assumptions. The Engineering Economist, 33(4), 275-302.

- De Reyck, B., Degraeve, Z., & Vandenborre, R. (2008). Project options valuation with net present value and decision tree analysis. European Journal of Operational Research, 184(1), 341-355.

- Elmaghraby, S. E., & Herroelen, W. S. (1990). The scheduling of activities to maximize the net present value of projects. European Journal of Operational Research, 49(1), 35-49.

- Ross, S. A. (1995). Uses, abuses, and alternatives to the net-present-value rule. Financial management, 24(3), 96-102.

How to cite this article:

Mulder, P. (2018). Net Present Value (NPV). Retrieved [insert date] from Toolshero: https://www.toolshero.com/financial-management/net-present-value-npv/

Original publication date: 05/07/2018 | Last update: 01/13/2024

Add a link to this page on your website:

<a href=” https://www.toolshero.com/financial-management/net-present-value-npv/”>Toolshero: Net Present Value (NPV)</a>