Capital Asset Pricing Model (CAPM)

Capital Asset Pricing Model (CAPM): This article explains the Capital Asset Pricing Model or CAPM in a practical way. This article contains the definition of the Capital Asset Pricing Model, its formula, a Capital Asset Pricing Model example and practical tips. After reading, you will understand the basic concept of financial modeling and this financial management model. Enjoy reading!

What is the Capital Asset Pricing Model? The basic theory explained

The Capital Asset Pricing Model (CAPM) is a model used to calculate the return that an investor should demand when making an investment, based on the risk he or she is taking.

A complete risk free rate does not happen very often. CAPM was independently developed by economists Jack L. Treynor, William Sharpe, John Lintner and Jan Mossin, based on Harry Markowitz’s Portfolio Theory.

The leading economists were William Sharpe, John Lintner and Jan Mossin, whose research was published in various specialized journals between 1964 and 1966.

The concern that attracted them to this subject was the development of explanatory and predictive models for the behaviour of financial assets. All had been influenced by Harry’s Portfolio Theory Markowitz, published in 1952 and reformulated in 1959.

In it, Markowitz plants the advantages of diversifying investments to reduce risk. The idea of diversifying investments implies distributing resources in various areas, such as: industry, construction, technologies, natural resources, R&D, health, etc. Markowitz called this a modern portfolio.

If that portfolio were diversified, it would be better in deal with the consequences of various risks. The CAPM goes one step further by seeking to maximize the return of each share and thus obtain an even more profitable portfolio.

The Markowitz portfolio model was deepened and enriched by the works of Sharpe: ‘Capital Asset Prices: A Theory of Market Equilibrium under Condition of Risk’, 1964; ‘Lintner: The Valuation of Risk Assets’ and the ‘Selection of Risky Investments in Stock Portfolios and Capital Budgets; 1965’, ‘Maximal Gains from Diversification; 1965’, and Mossin: ‘Equilibrium in a Capital Asset Market; 1966’.

It should be noted that Jack Treynores wrote in 1961 a rather pioneer: ‘Toward a Theory of the Market Value of Risky Assets’, but it did not reach a big audience. Sharpe, however, acknowledges in his work that he became aware of the work from Treynor.

For this important contribution to the development of the economy William Sharpe received the Nobel Prize in Economics (in conjunction with Harry Markowitz and Merton Miller) in 1990.

Capital Asset Pricing Model (CAPM) is based on the balance of the market and the profitability of the supply of financial assets, taking into account the risks of these assets by calculating the price of the asset or an investment portfolio. The Capital Asset Pricing Model (CAPM) predicts the risk of the asset by separating it into systematic risk and non-systematic risk.

Systematic risk is that of the general environment that we cannot control as a set of economic, political and social factors. Non-systematic risk is a company or industry-specific risk.

This CAPM model offers financial equilibrium of the supply of financial assets. In this way, the interaction of supply and demand defines the prices of the assets, directly assuming the profitability of the asset and the risk assumed.

Capital Asset Pricing Model background

To further understand this model, we must look to the past in Harry Markowitz’s Portfolio Theory or also known as the Modern Portfolio Theory based on the risk and return of financial investments since in this theory Markowitz shows the advantages of diversifying investments in order to reduce risk.

The idea of diversifying investments was to distribute resources in areas such as: industry, construction, technologies, natural resources, health, etc. Markowitz called this a portfolio, where his thesis was that the more diversified the portfolio, the better it would be to face the risks.

This is how the Portfolio Theory gives the importance of balanced investment in the diversification of the portfolio as this varies the reduction of prices. The idea of the modern portfolio method is to diversify the investments in different markets and terms in order to reduce the fluctuations in the total profitability of the portfolio and therefore also the risk.

With this clear, the influence of the CAPM model took a step forward by seeking to maximize the return of each share and obtain a more profitable portfolio. This allows the Capital Asset Pricing Model (CAPM) to build the optimal portfolio by determining with the greatest precision the percentages of investment in each of the assets.

With this track record, the Capital Asset Pricing Model (CAPM) becomes more powerful for today’s companies, which want to protect themselves from the systematic risk factors that can arise.

Capital Asset Pricing Model Formula explained

The CAPM is a model for calculating the price of an asset or a portfolio.

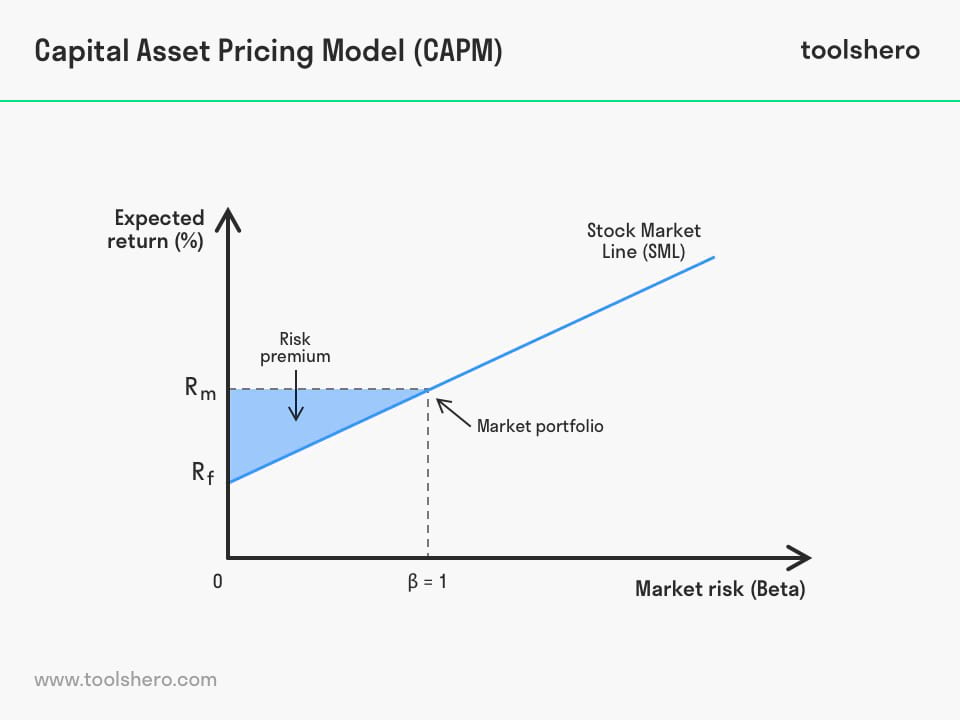

For individual assets, it is used from the Security Market Line (SML) which symbolizes the expected return of all assets in a market as a function of undiversifiable risk and its relationship to expected return and systematic risk (beta), to show how the market should estimate the price of an individual asset relative to the overall market.

We present the CAPM formula in a practical way so that you can understand what each item means and calculate the price of an asset:

E(ri) = rf + βim (E(rm) – rf)

Where:

E(ri) is the expected rate of return on capital on asset i

βim It is the beta (amount of risk with respect to the Market Portfolio), or also

βim = Cou (ri, rm), and Var (rm)

(E (rm) – rf) This is the market risk premium, i.e. the additional return that investors require to invest in risky assets, as opposed to the alternative of investing in risk-free assets.

(rm) Market return

(rf) Return on a risk-free asset: usually the return on a bond with a similar maturity to the life of the financial asset to be valued is used.

The expected return on an asset will be determined by the beta value as a measure of systematic risk.

Price of an asset

When the expected return E(Ri) is calculated using the Capital Asset Pricing Model (CAPM), the future cash flows that will be produced by that asset can be discounted from its net present value using that rate, in order to determine the price of the asset.

An asset is correctly priced when its observed price equals the value calculated using CAPM. If the price is higher than the valuation obtained, the asset is overvalued, and vice versa.

Return required for a specific asset with Beta

Beta reflects the specific undiversifiable risk sensitivity of the market, the market as a whole has a beta of 1. Since it is impossible to calculate the expected return of the entire market, indices such as the S&P 500 or the Dow Jones are usually used.

The Capital Asset Pricing Model (CAPM) calculates the appropriate and required rate of return for discounting the future cash flows that an asset will produce, taking into account the risk that the asset has. Betas greater than 1 means that the asset has a higher risk than the average for the entire market; betas below 1 means a lower risk.

Therefore, an asset with a high beta should be discounted at a higher rate, as a means of rewarding the investor for the risk the asset bears. This is the principle on which investors rely, the more risk the investment has, the higher the returns are required. In times of fortune it is normal for investors to operate with a high beta and in difficult times with a small beta.

Risk and diversification

Portfolio risk includes systematic risk, also known as undiversifiable risk. Diversifiable risk is the risk inherent in each individual asset. Diversifiable risk can be decreased by adding assets to the portfolio that mitigate each other, i.e. by diversifying the portfolio. However, systematic risk cannot be decreased.

Therefore, a rational investor should not take any risk that is diversifiable, as only undiversifiable risk is rewarded in the scope of this model. Therefore, the rate of return required for a given asset must be linked to the contribution that asset makes to the overall risk of a given portfolio.

In the following chart you will be able to visually understand the Financial Asset Valuation Model:

Figure 1 – Capital Asset Pricing Model graphic chart

Capital Asset Pricing Model (CAPM) assumptions

The model makes several assumptions about the behaviour of the market and its investors:

- Investors are risk averse people. For investments with a higher level of risk they will demand higher returns.

- Static model, not dynamic. Investors only consider one period. For example, one year.

- Investors only look at systematic risk. The market does not generate higher or lower returns on assets because of non-systematic risk.

- The return on assets corresponds to a normal distribution. Mathematical hope is associated with return. The standard deviation is associated with the level of risk. Therefore, investors are concerned about the deviation of the asset from the market in which it is quoted. Therefore, Beta is used as a measure of risk.

- The market is perfectly competitive. Each investor has a utility function and an initial wealth endowment. Investors will optimise their return on their assets in relation to their market.

- The supply of financial assets is an exogenous, fixed and known variable.

- All investors have the same information instantly and free of charge. Therefore, their expectations of profitability and risk for each type of financial asset are the same.

Disadvantages of the Capital Asset Pricing Model (CAPM)

- The Capital Asset Pricing Model (CAPM) does not correctly explain the valuation in the returns of securities. Empirical studies show that assets with low betas can offer higher returns than the model suggests

- The model assumes that investors have access to the same information, and that they agree on the risks and expected returns for all assets

- The market portfolio consists of all assets and all markets, where each asset is fair for its market capitalization. This assumes that investors have no preferences between markets and assets, and choose assets solely based on their risk-return profile

Conclusion

The Capital Asset Pricing Model (CAPM) can be used to calculate the rate of return that should be expected from an asset to compensate for the investment risk that the investor took with investing in the market. It could be said that it is the economic lifeline when taking the investment risk in which they expect greater profitability from their finances.

CAPM is one of the most important contributions in the financial sector of companies that is subject to the changing systematic risk factors of the market.

This model makes it possible to estimate the required return as the expected return on a financial asset such as a company’s ordinary shares. The rational investor then seeks to maximize his return while at the same time decreasing the systematic risk of his investment and with this maintain and buy the shares of a company.

Today the CAPM model is still popularly used by investors since it is a simple model to enter the field of finance that facilitates managing the results of high investment risks in the markets in which you want to participate.

It is your turn

What do you think? Do you have experience with financial modeling? Are you familiar with terms like interest rates and discount rates? Do you think that the Capital Asset Pricing Model (CAPM) allows the safe analysis of the return on investment in your company? Do you face more systematic or non-systematic risk in your business environment? Do you have anything else to suggest or add?

Share your experience and knowledge in the comments box below.

More information

- Ross, S. A. (1977). The capital asset pricing model (CAPM), short-sale restrictions and related issues. The Journal of Finance, 32(1), 177-183.

- Ross, S. A. (1978). The current status of the capital asset pricing model (CAPM). The Journal of Finance, 33(3), 885-901.

- Dempsey, M. (2013). The capital asset pricing model (CAPM): the history of a failed revolutionary idea in finance?. Abacus, 49, 7-23.

- Zabarankin, M., Pavlikov, K., & Uryasev, S. (2014). Capital asset pricing model (CAPM) with drawdown measure. European Journal of Operational Research, 234(2), 508-517.

How to cite this article:

Ospina Avendano, D. (2020). Capital Asset Pricing Model (CAPM). Retrieved [insert date] from Toolshero: https://www.toolshero.com/financial-management/capital-asset-pricing-model/

Published on: 03/14/2020 | Last update: 31/08/2023

Add a link to this page on your website:

<a href=”https://www.toolshero.com/financial-management/capital-asset-pricing-model/”>Toolshero: Capital Asset Pricing Model (CAPM)</a>