Principal Agent Problem

Principal Agent Problem: this article offers a practical explanation of the principal agent problem. Next to what it is and the definition and theory, this article also explains conflicts of interest, corrective mechanisms, the question “do financial bonuses offer a solution?”, including an answer, and a practical example of the principal agent problem. Enjoy reading!

What is a principal-agent problem?

Definition of the Principal Agent Problem

The principal-agent theory, or principal agent problem, or owner principal problem, is a concept that is used all over the world to understand the relationship between business principals and their representatives, or agents.

One example of this is the relationship between a company’s shareholders and the executive management. Shareholders are the principals in this case, while the executive management are the agents.

Principals delegate decision-making powers to their agents. That means that the decisions that are made by these agents have a financial impact on the principals. This can lead to differences of opinion regarding priorities, or worse.

Theory

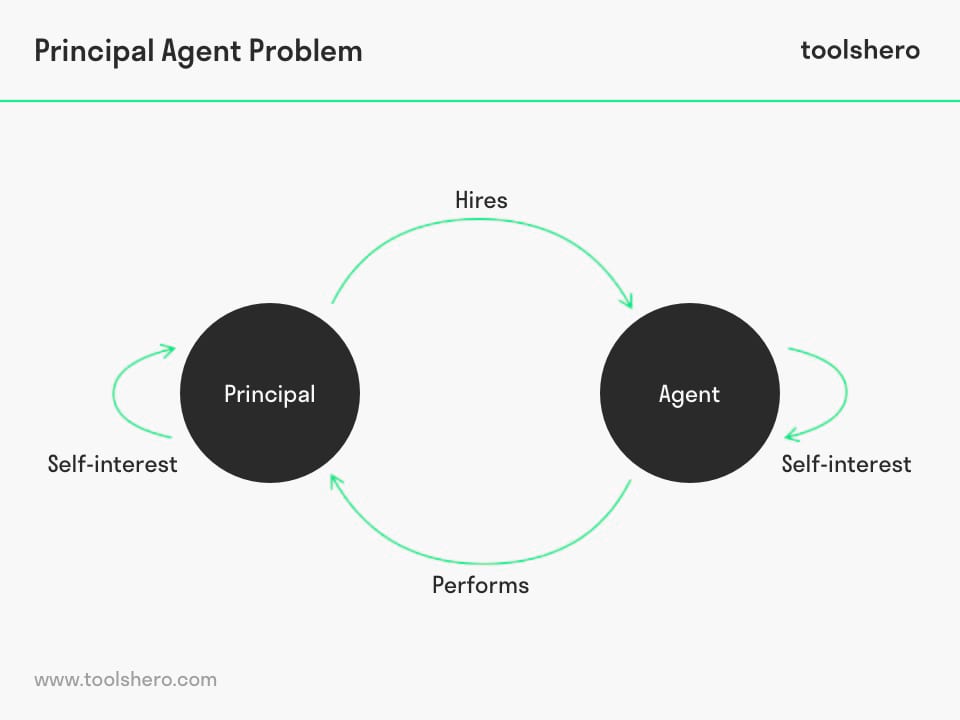

The principal agent problem arises when the agents are motivated to act in their own self-interest, which means acting in a way that conflicts with the principals’ interests. This theory is therefore about situations that bear a moral hazard.

Figure 1 – Principal Agent Problem model dynamics

The principal agent problem, or principal agent theory, was developed in the 1970s, resulting from the combined fields of economics and institutional theories.

Stephan Ross and Barry Mitnick are credited with coming up with the theory. The original idea behind the theory was described as a situation in which a person chooses an ice cream treat for another, without knowing what they want.

Conflicts of Interest and the Principal Agent Problem

Agents often have access to more information than the principals. This is also called information asymmetry, or asymmetric information access.

The consequence of that is that the principal does not know exactly what the agent will do and decide, but decisions have to be made in on behalf of the principals. Nor can the principal always ensure that the agent are acting in the best interest of the principals. The risk that an agent makes a bad decision, or that his policy conflicts with the principal’s interest is called agency cost.

A solution to the principal agent problem is to ensure that the agents are offered the right incentives to act in ways envisioned by the principals. This is called to align interests. These costs are part of the agency costs and corporate governance.

Real-world examples show that the agent doesn’t act with the interests of the principal in mind; instead they aim for their own goals.

Multiple Principals

The principal agent problem can become more complex if an agent acts on behalf of multiple principals. When that is the case, all the principals have to agree to the agent’s objectives and policy.

However, they are faced with a collective problem because different principals can influence individual agents to act in their particular interest, rather than the collective interest.

As a result, a host of problems can arise, such as free-riding in administrations, double administration, or conflicts between principals. All these factors lead to higher autonomy for the agent. This is also referred to as the multiple principals problem in this theory.

Corrective mechanisms

There are several mechanisms that can be employed to align the professional interests of the agent with the interests of the principal. One of the challenges is to design the contract with the agent in such a way that information asymmetry is prevented.

There also have to be incentives to make the agent act in the interests of the principal. Such incentives are rewards for performance, for instance in the form of:

- Commissions

- Profit sharing

- Stock options

- Other remunerations

Do financial bonuses offer a solution?

Using bonuses is an often-heard theory for countering the principal agent problem. By giving bonuses, the principal tries to align the agent’s interests with their own.

A common example of this is the use of bonuses in customer service departments. That encourages employees to offer good customer service, as it earns them a bonus.

There is some ambiguity about the effectiveness of bonuses. The big difference with the example of service employees is that the principals make it worth the effort for the agent to serve certain interests, while the service employees make more if they perform well, and less if they don’t.

That’s why the use of bonuses isn’t a perfect solution for the principal agent problem. Hoping to get a bigger bonus, they can cut into the principal’s company’s profits and still serve their own interest. Bonuses can also lead to ignoring interests for which there is no reward.

Example of the Principal Agent Problem

The principal agent problem can be seen in politics as well. This example is about a city council member for a large city. This council member is positioned between the local government and the people.

As a result, the council member has access to more information than the principal; information asymmetry. A city council member also serves the interests of the local government regarding specific policy fields. One of those is spatial planning.

The council member regularly speaks to the local business owners in his city. One day, one of his friends from the business community comes to him with a request: ‘Can you help my restaurant get a permit to extend its opening hours to 2AM? There will of course be something in it for you.’

The council member’s interests now are no longer aligned with those of the city. The city actually wants the number of those types of permits reduced because of complaints by local residents.

In politics it’s less common to use compensation methods to make the agent act in the interests of the people. After all, it’s expected of politicians that they act with integrity when making decisions and not be tempted to get in trouble as a result of a conflict of interest. In business, financial bonuses are quite common.

Short summary of the Principal Agent Problem

The principal agent problem is about the way in which organisations are owned and how they are managed. The shareholders, owners, usually appoint a board of directors. The board of directors monitors and guides high-level management. These executives are the agents in this example.

The principal agent problem arises when these agents act in their own interests or those of someone else. Agents usually have access to more information than the principals. This notion is also called information asymmetry.

The problem becomes more complex if the agents act on behalf of multiple principals in the same network. The principals can then try to lobby with the agents to make them act in their interests.

Different mechanisms are used to prevent this. One way to minimise conflicts of interest is by giving rewards.

Now It’s Your Turn

What do you think? Do you recognise this explanation of the principal agent theory? Have you been in situations that qualified as a principal agent problem or other conflicts of interest? How could you increase the integrity of both the agent and the principal? Do you have any tips or additional comments?

Share your experience and knowledge in the comments box below.

- Braun, D., & Guston, D. H. (2003). Principal-agent theory and research policy: an introduction. Science and public policy, 30(5), 302-308.

- Garen, J. E. (1994). Executive compensation and principal-agent theory. Journal of political economy, 102(6), 1175-1199.

- Laffont, J. J., & Martimort, D. (2009). The theory of incentives: the principal-agent model. Princeton university press.

How to cite this article:

Janse, B. (2019). Principal Agent Problem. Retrieved [insert date] from Toolshero: https://www.toolshero.com/management/principal-agent-problem/

Published on: 01/16/2020 | Last update: 08/02/2023

Add a link to this page on your website:

<a href=”https://www.toolshero.com/management/principal-agent-problem/”>Toolshero: Principal Agent Problem</a>