Risk Management Process and Definition

Risk Management Process: this article provides a practical explanation of the risk management process. The article starts with a general definition and meaning of risk management and where risk management plays an important role. The process of risk management is also discussed and which methods and models are popular. Enjoy reading!

What is Risk Management?

Risk Management (RM) refers to identifying and categorising, as well as taking measures regarding risks organisations are exposed to. Although risk management is part of every industry, RM in the financial world receives a great deal of attention. Here, the stakes are high and investors benefit greatly from accurate risk assessment.

Risk management is also an important component of projects. This concerns the identification of, analysis of and reaction to each risk that could cause problems during a project’s life cycle and could keep the team from achieving its objectives.

What is a Risk?

A general definition of a risk is an uncertain event that, if it occurs, can have an uncertain effect on the objectives of a company or project. This risk, the chance that something will or will not happen, is an important concept in risk management.

Risks don’t necessarily have negative consequences. When used intelligently, they can open doors to smarter, better streamlined and more profitable processes.

Insufficiently managing and anticipating risks can have severe consequences for organisations, individuals and even for economy as a whole.

The Great Recession has also been associated to faulty Risk Management, such as banks and mortgage lenders who provided mortgages to people with poor financial positions.

Risk Management Process in Six Components

In Risk Management, countless tools are used and many different methods are applied in the actual managing of these risks. Although some steps are described differently, these five risk management process steps combined form a simple and complete image of risk management:

Objective

Organisations generally have one or multiple objectives. Since the financial crisis, some companies are afraid to take risks and risk management receives more attention in general. The extent to which organisations are willing to take risks is referred to as risk appetite.

The organisation might be aversive to risks in general, or be willing to take risks. Regardless of the view of risks, coordinating successful risk management with business operations demands organisations to clearly describe their risk appetite and match this to their objectives.

Identifying

In this phase, risks are identified in order to manage them before they can have a negative effect on an organisation’s performance or a project’s objectives.

Risks can exist both in sources within the project or external sources. There are multiple methods for risk assessment. One such method is the Failure Mode and Effect Analysis.

Analysing

Risk analysis is an important part of Risk Management. Use a SWOT analysis to identify threats or strengths.

Risk analysis consists of qualitative and quantitative risk analysis. Investors need figures. Therefore, they often use a quantitative method to analyse risks, expressed in measurable terms.

In qualitative risk analysis, scenarios are sketched. The advantage of this is that human aspects can be included that can’t be expressed in measurable terms.

Assessing

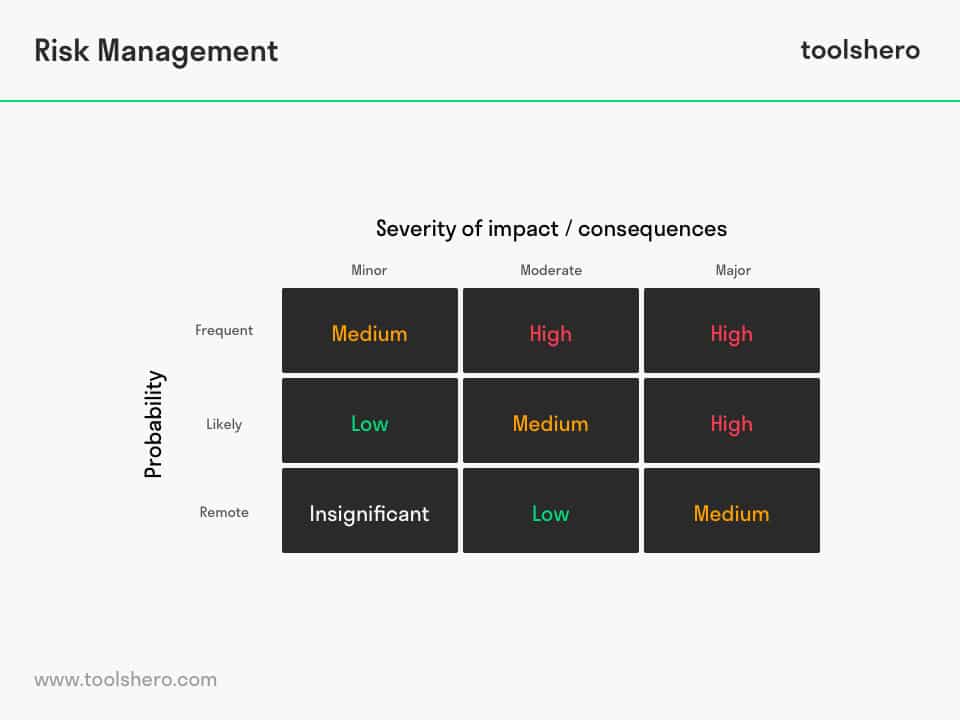

It’s not necessary to respond to each risk immediately. Therefore, all identified risks are assessed and labelled within risk management. A risk assessment matrix is generally filled in for this purpose, as below.

Along the X-axis, it’s represented how much impact the risk will have on the organisation, and along the Y-axis, the chance that the risk becomes a reality is visualised.

Figure 1 – Risk management analysis matrix

Managing

Now that the risks have been identified and categorised, possible action must be taken.

Previously, we indicated that risks aren’t always negative, so it’s also possible that no measures need to be taken regarding risks. In general, there are four possibilities to respond to a risk in risk management:

First, the organisation can decide to avoid the risk. This happens frequently. The organisation investigates the processes and discovers that an element from the process involves too much risk. Subsequently, it’s decided to adapt the process or outsource it.

Another possibility is to reduce the risk. Reducing risks—particularly the consequences of a risk—can be achieved by taking out insurance that pays in case of damage, for instance.

The risks can also be transferred. When it’s decided to outsource a risky process, the organisation relinquishes the risk and another becomes responsible for the risk.

When the organisation doesn’t see any reason to anticipate on a risk, or when the risk is planned, the risk is accepted.

A risk can also be accepted in a forced manner when the responsible party doesn’t have the opportunity to avoid, reduce or transfer the risk.

Monitoring risk management

In the last step of Risk Management, the organisation uses a risk registry to guard, monitor and assess risks. The core of a risk is the uncertainty.

Irrespective of how positive an organisation’s position might seem to be, risks will practically always exist. This means that an organisation will be much more confident when an extensive list of risks has been identified that is able to keep unpleasant surprises and barriers at bay.

Artificial Intelligence and Risk Management

Artificial Intelligence (AI) is a game changer where risk management is concerned, particularly for financial institutions such as banks and other credit providers. Artificial Intelligence (AI) offers solutions for identifying potential risks and preventing fraud.

The financial crisis of the previous decade, as discussed earlier, was partly caused by the fact that money-lending companies provided credit to people with financial problems too easily. These decisions were based on several simple heuristics and obtained customer data wasn’t always realistic.

In hindsight, the financial crisis also proved to be the starting point of a digital revolution in the financial sector. Nowadays, new, complex technologies provide organisations with access to huge amounts of information and data on the customer’s behaviour and needs.

The credit problem is one of the problems that could be addressed by this revolution. Bankers use a credit card score to determine who is eligible for a credit card and who isn’t. Grouping people in this way isn’t efficient for all companies.

As Artificial Intelligence (AI) is data driven and data dependent, this technology forms a basis for developing a system that can make recommendations for loans and credits.

Artificial Intelligence (AI) also supports Risk Management in identifying fraud. Bankers who issue loans use other people’s money to do so. Therefore, these institutions take fraud very seriously. It helps to map the spending behaviour of individuals and use this for various instruments that uncover unusual behaviour.

Now It’s Your Turn

What do you think? Do you recognise the explanation of Risk Management? To what extent do you work on managing risks in your environment? Which tools do you use to identify and monitor risks? Do you have any tips or additional comments?

Share your experience and knowledge in the comments box below.

More information

- Saunders, A., Cornett, M. M., & McGraw, P. A. (2006). Financial institutions management: A risk management approach. New York, NY, USA: McGraw-Hill.

- Chapman, C., & Ward, S. (1996). Project risk management: processes, techniques and insights. John Wiley.

- More, M. (1993). Risk Management for Construction.

How to cite this article:

Janse, B. (2019). Risk Management Process. Retrieved [insert date] from Toolshero: https://www.toolshero.com/management/risk-management/

Original publication date: 05/01/20219 | Last update: 01/22/2024

Add a link to this page on your website:

<a href=”https://www.toolshero.com/management/risk-management/”>Toolshero: Risk Management Process</a>